- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

The Complete Guide to Cryptocurrency Investment Strategies

People are going crazy over cryptocurrency investment. The reason for this is not far-fetched; cryptocurrency is the future. The crypto space is having a profound effect on numerous industries, not just the financial sector.

- Differences Between Investment and Trading

- Fundamental Analysis vs. Technical Analysis: The Foundations of Crypto Investment Strategies

- Top Cryptocurrency Investment Strategies

- Things to Consider Before Choosing a Cryptocurrency Investment Strategy

- How to Choose the Best Cryptocurrencies to Invest In

- Is Crypto a Good Long-Term Investment?

- Should Everyone Invest in Crypto?

- Conclusion

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Over the past ten years, thousands of digital currencies have been launched, and some, like Bitcoin and Ethereum, have quickly become popular.

However, the reality is that not every crypto is the same. It is important to know the risks of investing in cryptocurrency so that you can take advantage of the opportunities and avoid the risks.

If you want to invest in cryptocurrency in a way that is appropriate for your level of risk tolerance, you should have a firm grasp of the fundamental crypto investing strategies.

If you are interested in cryptocurrency investment, you have come to the right place. This guide will explore the difference between cryptocurrency investment and trading, how to find the best cryptocurrencies to invest in, different cryptocurrency investment strategies, and lots more.

Differences Between Investment and Trading

Investing and trading are two different methods of profiting from movements in the financial markets. Whilst both have the same goal, each method uses a different approach.

Duration

Some investors profit from long-term commitments and keep their assets for years – even decades. Trading, on the other hand, happens over a much shorter period: daily, monthly, or quarterly to take advantage of rapid price fluctuations – which long-term investors typically ignore.

Transaction Frequency

Traders place many orders since short-term price changes cannot yield significant profits on their own. Traders must then make up for this with higher trading volumes.

Risks

No method of interacting with the cryptocurrency market comes without risk due to the multitude of transactions. However, trading is considered a high-risk and high-return approach. With long-term investing, profits accumulate gradually – but there are still risks – just not as significant over a shorter period.

Skill

Trading requires technical skills, whereas investing requires a deeper understanding of the market. In many ways, investors study the psychology of the market, whereas traders are more focussed on the numbers and charts.

Fundamental Analysis vs. Technical Analysis: The Foundations of Crypto Investment Strategies

Fundamental analysis is based on how the asset price is impacted by how the market moves and news within the company. These factors include financial statements from top management, profit margins, cryptocurrency news, political events, and even natural disasters.

Based on these underlying forces, analysts can evaluate whether an asset is underpriced or overpriced.

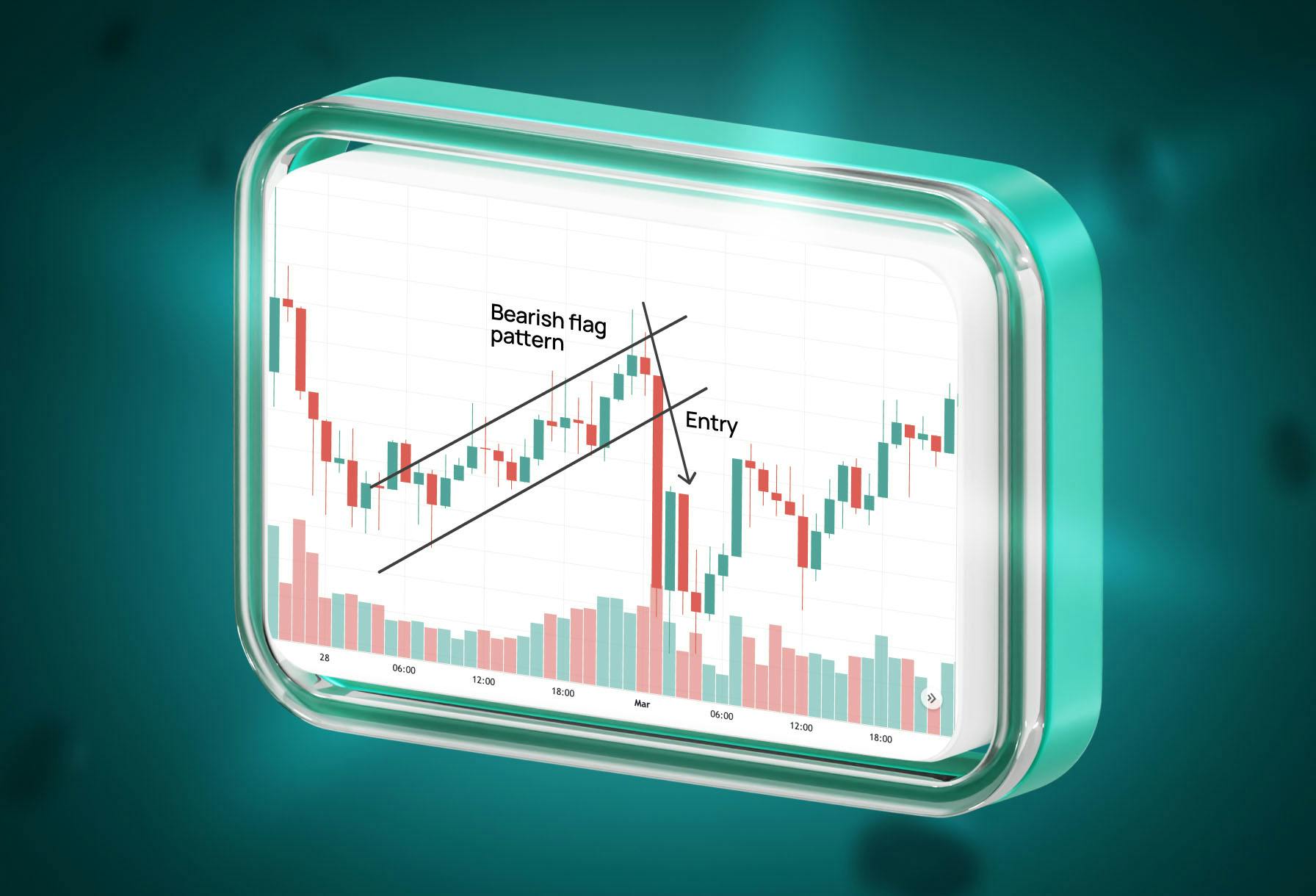

Technical analysis uses price charts, resistance, and support, indicators, patterns, and trends from the past to predict future price movements. In other words, it gives market participants a comprehensive overview of past performance statistics. It also studies the interaction of demand and supply forces, which are also believed to affect the price.

The key differences between the two approaches can be described in the following points:

- Fundamental analysis considers more extended periods of asset history. In this context, fundamental analysis is more likely to be used for long-term trading. Technical analysis better suits short-term and swing traders.

- Investors usually apply fundamental analysis, whereas traders prefer technical analysis. The fundamental analysis informs investors on whether they should buy and hold the asset for a certain period, while technical analysis advises about quick profits.

- Fundamental analysis recognizes that the asset is not only affected by the past. The technical analysis normally doesn’t consider current events – rather, it studies how the asset behaved in the past.

- Technical analysis is better at determining the right time to enter and exit the market, whereas fundamental analysis studies the intrinsic value of the currency.

Top Cryptocurrency Investment Strategies

Although it’s easy to buy a cryptocurrency, putting a plan into action as you invest is something entirely different.

A cryptocurrency investment strategy is nothing more than a set of guidelines for making decisions about when, where, and how much to invest in various asset classes. There are lots of methods that can be used to invest in and trade cryptocurrencies.

A conservative approach would prioritize low-risk investments and portfolios, but there are many other options to consider. The goal of this plan is wealth preservation. On the other hand, you could choose a more daring strategy that involves high-risk, high-reward investments. Accumulating more wealth is the aim here.

There are positive and negative outcomes to each possible strategy. However, to give you a general idea of how you can invest in crypto, we will look at some of the most common crypto investment strategies.

Buy and Hold

The "buy and hold strategy" is widely regarded as the best method for investing in cryptocurrencies. Lots of crypto investors refer to it as “HODL.” Interestingly, the general public believes this is just a typo that was adopted over time.

Some people think that HODL stands for "hold on for dear life," but others dispute this interpretation. The term "HODLing" refers to the practice of purchasing cryptocurrencies and keeping them in a digital wallet for a long period. In practice, you won't be trading cryptocurrencies all that often if you opt for the buy-and-hold strategy. All you do is buy coins and store them.

Pros

- It is the best strategy for new investors to get started with cryptocurrency investment.

- It is less technical day trading, which is both time-consuming and difficult.

- Unlike other strategies, it is easier to learn and doesn't need your full attention.

Cons

- The strategy does not take full advantage of bitcoin's volatility.

- Other strategies, if done correctly, can yield more profits since they don’t rely on spikes in bitcoin’s price (but on the ability to spot opportunities in the market).

- Bitcoin (and the other cryptocurrencies involved) are seen as investment tools and not as means of payment.

Dollar-Cost Averaging

Instead of investing all of your money at once when you think the market has reached the bottom, you can use dollar-cost averaging to spread out your purchases over time and spread out your losses. This strategy implies that you will spend less money in the long run compared to if you tried to time the market.

Pros

- It reduces emotional investment.

- It helps you avoid bad timing.

Con

- It does not replace the strategy for detecting good investments.

Elliott Wave Theory

Traders who engage in technical analysis based on market sentiment often turn to Elliott Wave Theory in their search for repeating patterns. Such patterns are used for the analysis of market cycles and the prediction of future trends.

Elliott Wave Theory is a method for forecasting market movements that takes into account both the technical analysis of price charts and the identification of extremes in the psychology of investors.

Elliott found that people's emotional and intuitive responses to the market manifested themselves in the waves he predicted. His theory has been around for over 80 years, but it is still widely used as a powerful tool in the trading and investing world.

Pros

- Elliott's model is meant to assist investors in pinpointing the point of a potential reversal.

- If you could predict when a market would form a top or bottom, you could place your buy and sell orders accordingly and make a profit. So, it would be possible to predict where the price will go in the future if we could find the patterns in prices.

- It is possible to make profits on both sides of the trend.

- The 5th wave of Elliott Wave Theory provides a clear price target, which can be used to profitably book long-term investments and gauge market sentiment.

- Technical patterns like double- and triple-tops and head-and-shoulder tops can be found with Elliott wave analysis.

Con

- It can be hard to tell when a wave has started or ended because it depends on many factors.

Things to Consider Before Choosing a Cryptocurrency Investment Strategy

Every successful investment has a well-written, measurable, and reproducible strategy. Issues arise when investors jump from premade strategies to creating their own without much deliberation. Here are some key points to consider when designing a suitable strategy:

Current Financial Situation

The most important factor to consider when creating a cryptocurrency investment strategy is a thorough financial plan. There are no guarantees that investments will yield great profits so investors must decipher their after-tax income vs. spending ratio, and how much money can be comfortably allocated to investing.

Risk Tolerance and Desirable Return

A risk management plan and future strategy should account for the inherent risks of a specific asset category. How much of a risk are you willing to take for a higher ROI potential?

The Timeline

A strategy for the long term, i.e., for decades, will be different from a short-term one. Investors must consider what they are saving for (retirements, property, etc.) and decide if they need a shorter, safer strategy.

Applicability to Different Market Environments

Investors need to acknowledge that the market is not always going to be on their side. Hence, they need to figure out how their strategy would perform in different conditions. They also need to know their strategies’ strengths and weaknesses.

The Effectiveness of the Investment Strategy

Strategies need to be revisited and adjusted from time to time. You should be able to evaluate whether your crypto investment strategy matches your investment goals.

How to Choose the Best Cryptocurrencies to Invest In

Here are some factors to look out for when deciding the best cryptocurrency to put your money into:

The Founding Team

The teams behind the most credible cryptocurrencies are competent and widely respected in their fields. Team members should have extensive, relevant experience, high credibility, and a strong online reputation. It is up to the people who made the cryptocurrency to decide what will happen to it in the long run.

Here are some things to keep in mind as you dig deeper into the company's founders, developers, marketers, etc.:

- Is the team ambitious?

- What results have they gotten before?

- Is their expertise convincing?

The Fundamentals

It makes sense to look for ways to decide on the best crypto to invest in today and make a choice that doesn't require technical expertise and years of market experience because learning the technical stuff will take time.

The use of fundamental analysis is one such method. It's useful for getting an aerial view of the project, including its user base, practical applications, financials, and potential future applications. If you use fundamental analysis, you can choose a cryptocurrency that has a better chance of being around for a long period. That's how you'll detect the most promising digital currency investments.

The White Paper

This explains the technology behind the coin, why it was created, how it operates, the problems it aims to solve, and, most importantly, the goals of its creators. If you want to get down to the nitty-gritty of a coin, a white paper is a great place to start.

The Community

People's interest and faith in a crypto project are evidenced by the robust community surrounding it. To find out which cryptocurrency is currently the most sought-after, investigate some related content on Reddit or view some related videos on YouTube. You can learn a lot about the people who are behind it from these platforms.

The Problem(s) the Cryptocurrency is Trying to Solve

Understanding how a crypto project works is important because it shows the problems that the project is trying to solve. The problems the coin causes should also be investigated. You shouldn't put your money into a coin if it causes more problems than it solves.

Market Capitalization

It is also important to pay attention to a cryptocurrency's market capitalization. This is determined by multiplying the current price of a cryptocurrency by the number of coins in circulation.

Generally, a higher market cap indicates a more secure investment. However, there are exceptions to this rule in the cryptocurrency market. You should avoid investing in a cryptocurrency with a tiny market capitalization because it's probably brand new and has a high degree of uncertainty attached to it.

In addition, a crypto asset's market cap paints a more accurate picture of its development prospects. Cryptocurrencies with smaller market capitalizations than others have a bigger chance of growing in the future.

As a result of the extreme volatility of cryptocurrency prices, market capitalization keeps changing. Due to the volatility of the market and the possibility of a collapse, it is advisable to only invest money that you can afford to lose.

Is Crypto a Good Long-Term Investment?

Cryptocurrency investments carry a high degree of uncertainty, but when done correctly and as part of a diversified portfolio, they can yield positive returns. If you want to get in front of the rising demand for digital currency, investing in cryptocurrencies is a smart move.

Should Everyone Invest in Crypto?

Cryptocurrency is a game-changing innovation that deserves attention from all types of investors. Cryptocurrencies could be a good way to save money because they can't be seized or printed.

However, cryptocurrency investments are still risky, and their widespread adoption is not guaranteed. Before putting money into cryptocurrency, it's important to learn about the complicated security rules that must be followed.

Conclusion

Deciding on a cryptocurrency investment strategy can feel complicated. Ultimately, it comes down to trial and error and when immersing yourself in a new market, you will slowly learn what you are good at and what techniques to avoid.

To minimize the impact of mistakes, figure out your specific investment objectives, risk tolerance, available funds, and particular preferences. Then you will be able to see clearly which strategy suits you best. It might be something from this list, or you may come across an even better one for your goals.

If you are still unsure of what strategy to use, the 3Commas trading platform is the perfect way to start your cryptocurrency investment journey. The platform offers functionality for any investment and trading technique (from automated bots to customizable strategies). 3Commas is also suitable for both beginners and professional investors and traders.

FAQ

Yes, you can get rich investing in cryptocurrency. However, most crypto assets are extremely high-risk due to their volatile nature. Also, some even require specialized knowledge or experience to invest in.

No single strategy can be considered the best cryptocurrency investment strategy. However, the "buy and hold strategy" is widely regarded as the best method for investing in cryptocurrencies. It is a common strategy among crypto investors. When used correctly, it can yield substantial gains.

Investing in Bitcoin or any other digital currency is risky. There is no assurance that you will get back any of the money you invest in bitcoin, whether you intend to use the money to buy goods or services or whether you plan to hold the asset until its value increases. Hence, it's not wise to put all your savings in cryptocurrency.

Adedamola is a highly resourceful content writer with comprehensive experience in researching and creating simple content that engage and educate the audience. He is interested in improving the marketing results of blockchain and crypto brands through great content.

READ MORE

- Differences Between Investment and Trading

- Fundamental Analysis vs. Technical Analysis: The Foundations of Crypto Investment Strategies

- Top Cryptocurrency Investment Strategies

- Things to Consider Before Choosing a Cryptocurrency Investment Strategy

- How to Choose the Best Cryptocurrencies to Invest In

- Is Crypto a Good Long-Term Investment?

- Should Everyone Invest in Crypto?

- Conclusion