- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Watch out for scams: Effects of Crypto Pyramids on the Industry

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Cryptocurrencies, as an innovative investment tool, attract the attention of numerous people and organizations pursuing all kinds of interests. Anytime money can be made, fraudsters and malicious actors come to prey on the unsuspecting, and the cryptocurrency industry is no different.

In today’s article, we will talk about cryptocurrency pyramid schemes, their impact on the crypto industry and the examples of the biggest scams in the cryptocurrency space.

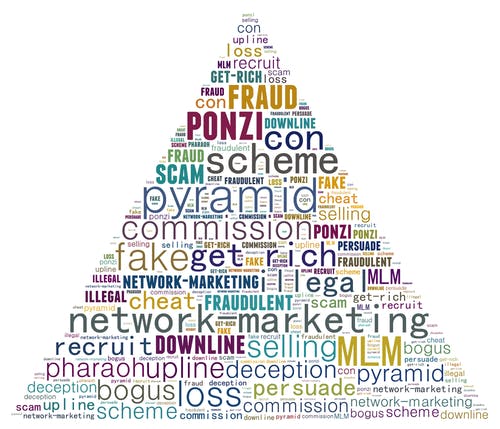

Pyramid schemes

More than a century has passed since the first Ponzi scheme made its appearance, thus creating a new paradigm of fraud in its wake. Since the inception of this fraudulent scheme, it has undergone significant changes, and with the advent of cryptocurrencies it has gained wide popularity and diversity.

A pyramid scheme is structured in a way where an initial actor recruits other investors, who in their turn, must recruit more investors, taking a percent of the invested funds and passing the rest to the senior members in the chain. This is the distinctive feature of financial pyramids that have stemmed from Ponzi schemes. Sooner or later, such an organization will not be able to fulfill its organizers’ obligations to the depositors. As the number of new users increases, the need to attract new funds increases. Before depositors wise up to what is happening, the organizers of the scheme disappear with the users’ funds long before the collapse of the pyramid.

The largest fraud in the history of Ponzi schemes was conducted by Bernard Madoff in which he managed to steal over $50 billion. The victims of Bernard’s fraud were the largest American investment companies, foundations, corporations, and many celebrities. Madoff was able to defraud investors for more than 10 years after the scheme was discovered in 2008.

What does this have to do with cryptocurrencies?

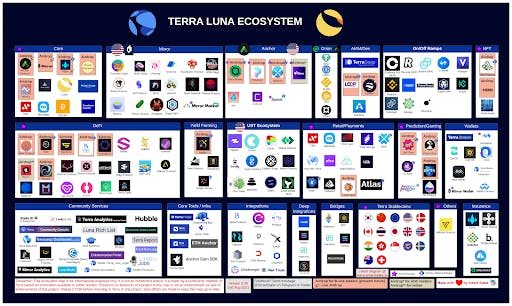

The advent of blockchain technology and cryptocurrencies resulted in the emergence of numerous fraudulent schemes. Among the ubiquitous ones are pyramid schemes, which have become “high-yield investment vehicles” that trick their participants into investing funds under the guise of innovative products and cryptocurrency startups.

To create a traditional pyramid scheme, a company must be set up and incorporated as a legal entity. This also requires a bank account to raise funds and obtain a license if applicable. Given the regulatory controls of the government, such companies have to disguise themselves carefully. Due to their structure and anonymous capabilities, cryptocurrencies make it easier for such companies to operate and allow them to reach a large audience, raise significant funds while staying out of the sight of law enforcement agencies.

In fact, with the advent and popularization of blockchain technology, pyramid scheme organizers do not need to open companies, register accounts, and, in some cases, don’t even create any product. By going digital, organizers of fraudulent schemes create their own tokens used to sell to investors. These tokens often do not even exist, but investors have the impression that the project is developing and issued coins are rising in value. For large-scale scams, media personalities, influencers, and celebrities are attracted to promote the project and attract even more investors.

The creation of such a huge number of cryptocurrency pyramid schemes is caused by the low level of financial literacy of most newcomers to the industry. The organizers of such schemes focus on the fact that many inexperienced users in search of “Bitcoin 2.0” are searching to get rich quickly and invest their funds in projects in which they don’t understand. But even more experienced investors have also fallen prey to these scams.

The largest cryptocurrency pyramids

Lately, the number of crypto pyramid schemes has grown rapidly, and the scale of the damage is impressive. Despite the long history of pyramid schemes and many real-life examples of fraud in the past, the number of such scams is growing every year. With the advent of DeFi, such schemes have become more sophisticated and complex, while the number of people hungry for easy money is increasing.

The following crypto pyramid schemes have defrauded suspecting investors out of millions of dollars.

OneCoin

The OneCoin project is the standard of cryptocurrency pyramid schemes. The project’s organizers presented it as a “Bitcoin killer,” and naive investors willingly believed the tale. The fake token, without any underlying technology or application methods, was traded on the OneExchange created by its organizers, and users from all over the world, including China, India, Africa, the Middle East, and Europe, were buying investment education packages and tokens. The scale of the project can also be judged by the fact that many reputable publications, such as Forbes, for example, released interviews with the project’s organizers.

According to different estimates, the project managed to collect over $4 billion, but even after the arrest of the project’s organizers and managers, the scheme continued to function in many countries, collecting money from its users.

BitConnect

BitConnect was launched in 2016 as an initial coin offering (ICO), and already in 2017, the BCC project token was among the most popular and fastest-growing in the entire industry. The organizers offered an investment program in which users received interest on invested funds. As already mentioned, some pyramid schemes have a complex and sophisticated structure, which allows them to avoid suspicion and attract massive funds. It is also important that these schemes appear legitimate to any potential investor. Bitconnect’s BCC token was able to hold a big presence in the crypto space, and was presented on Coinmarketcap as a legitimate project.

During the rally of the entire cryptocurrency market in 2017, the capitalization of the project reached almost $3 billion, and the BCC token reached $463. In 2018, the project was shut down, and the token price lost more than 96% in value, leaving depositors with nothing. Investors have lost up to $3.5 billion over the project’s lifetime to-date.

Impact on the cryptocurrency industry

Many gullible users, having no basic understanding of cryptocurrencies and their structure, are observing the success of others, and invest their funds into fraudulent projects, thereby becoming disappointed with cryptocurrencies. Bitcoin itself is often called a pyramid scheme. Such misguided beliefs are associated primarily with negative past experiences like that of previous crypto pyramid schemes. Those who have lost funds in pyramid schemes associate cryptocurrencies with something similar, refusing to understand the issue.

In addition to false beliefs about the purpose of cryptocurrencies, pyramid schemes attract potential users’ attention. For cryptocurrencies to be universally accepted, they need to attract new participants. The difference between Bitcoin and pyramid schemes is that in the first case, new participants are needed for broader acceptance by the masses, while the generation of profits drives the attraction of users to pyramid schemes to enrich the organizers.

Offering high returns, happyness, and success, fraudulent projects shape users’ speculative view of the nature of cryptocurrencies, thus diverting their attention away from the real purpose of digital money, which is to rebuild a financial system free from control by the wealthy or any single entity.

Conclusion

To not fall victim to a financial pyramid scheme, it is necessary to improve one’s financial literacy and question anything that seems too good to be true. Promises of high returns and future success of an “innovative” project are likely to remain promises, as they aim to rob users of their money. Oftentimes, the distinctive features of fraudulent schemes are also referral systems, closed-source, or the lack of listings on popular exchanges or analytical platforms. Of course, some people manage to get out of such projects in time and even earn money, but as the numbers show, most participants instead lose significant capital. Instead, it’s better to take the time to research and educate yourself on cryptocurrencies and their uses, this will lead to wiser investments and avoid potential crypto pyramid schemes.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.