- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

What Is Spark (FLR) and the Flare Network?

Learn how Flare Network and its Spark (FLR) token have become essential for AI crypto trading bots, providing secure, real-time off-chain and cross-chain data for automated decision-making and strategic adjustments.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Introduction:

In the ever-evolving landscape of blockchain technology, innovation knows no bounds. One remarkable project that has caught the attention of crypto enthusiasts and investors alike is the Flare Network and its native token, Spark (FLR). In a world where blockchain values are often locked away, the Flare Network offers a groundbreaking solution by unlocking new possibilities for cryptocurrencies. In this comprehensive guide, we will delve into the intricacies of Flare Network and Spark, shedding light on their significance in the crypto ecosystem.

Flare Network: A Paradigm Shift in Consensus

At the heart of the Flare Network lies a revolutionary consensus mechanism known as the Federated Byzantine Agreement (FBA). Unlike traditional proof-of-work or proof-of-stake mechanisms, FBA operates on principles of safety without the need for economic incentives. This unique approach opens doors for high-value and high-risk use-cases, ensuring the network's robustness.

The Flare Network leverages the Ethereum Virtual Machine (EVM), empowering it to execute Turing-complete smart contracts. An ingenious addition to this ecosystem is the Flare Virtual Machine, akin to the EVM but tailored to convert complex smart contracts into manageable instructions. This transformation paves the way for a decentralized applications ecosystem of unprecedented potential.

Spark: The Catalyst for Smart Contracts

Spark, the native token of the Flare Network, plays a pivotal role in enabling smart contracts for cryptocurrencies like XRP, albeit on a distinct network. While platforms like Ethereum host smart contracts within their blockchain, Spark extends this capability beyond, allowing for more versatile applications.

Unlocking the Value of Blockchain Networks

One of the inherent challenges in blockchain networks is the limited utility of a significant portion of their value through smart contracts. The Flare Network challenges this status quo, emphasizing the importance of safety in Proof-of-Stake (PoS) networks. While PoS networks secure their platforms through native tokens, they often lack alternative use-cases. Flare Network strives to bridge this gap by offering a diverse array of financial products and tools.

Flare Finance: A Decentralized DeFi Ecosystem

Enter Flare Finance, a pioneering decentralized finance (DeFi) platform that aligns perfectly with the Flare Network's vision. It empowers XRP holders with a unique governance structure, ensuring that every stakeholder has a say in its future. The Flare Finance ecosystem boasts several remarkable offerings:

- FlareX: A decentralized exchange that enables users to trade currencies and earn passive income through liquidity provision.

- FlareWrap: A bridging solution that simplifies transactions and reduces fees, allowing users to maximize their earnings.

- FlareFarm: A platform for generating yield through staking various assets, offering users the opportunity for passive income.

- FlareMine: A decentralized mining pool where users can mine Bitcoin and Ethereum, converting their earnings into FLR (Spark) for additional interest.

- FlareLoans: A platform for decentralized loans with lower collateral requirements compared to other DeFi platforms.

- FlareMutual: A safeguard for projects on Flare Network, sharing the risks and rewards among users.

The World of Flare Tokens

In the Flare Finance ecosystem, three essential tokens take center stage:

- YieldFlare (YFLR): The primary token used for commissions and governance within Flare Finance, giving stakeholders voting power.

- YieldFin (YFIN): A governance token offering substantial voting power, which remains unspent after voting.

- YieldMine (YMIN): A reward token for users providing computing power on the FlareMine platform.

Spark Tokens: A World of Possibilities

Spark, as the native token of the Flare Network, serves as collateral for issuing various F-assets within decentralized applications. It also facilitates governance, data provision, and spam prevention, all while leveraging transaction fees within the network.

Flare Network and Ripple: A Symbiotic Relationship

Flare Network's incorporation of the Ethereum Virtual Machine and smart contracts creates exciting possibilities for Ripple (XRP). It acts as a bridge between the XRP Ledger and Ethereum, enabling XRP to be used for decentralized applications, DeFi solutions, and NFTs.

FXRP and F-Assets: Bridging Two Worlds

FXRP, one of four F-assets on the Flare Network, represents XRP on this innovative platform. Minting FXRP involves a decentralized process that ensures the value peg with XRP, supported by Spark tokens. This seamless bridge between two chains is a game-changer for interoperability in the crypto world.

Intricacies of FXRP and the Decentralized Bridge

The process of bridging two chains and moving tokens between them, as seen with FXRP, is entirely decentralized. Agents play a crucial role, with Spark tokens acting as collateral. The network rewards users if agents fail to meet deadlines, ensuring security and trust in the process.

What Is Spark (FLR) and the Flare Network?

If you wanted to reach the value of every blockchain, that would be impossible. The value of over 65% blockchain dApps is locked and that’s a challenge to surpass for projects like Flare network. Flare unlocks additional versatility for cryptos, touching no security properties. This article is a thorough guide to answer questions like how does the Flare network operates and What is flare network spark.

What is the Flare network?

Commonly mentioned in the form of FLR abbreviation address, Flare is the first Turing-complete Federated Byzantine Agreement (FBA) network in the world. The Avalanche consensus mechanism is used by nodes, with a key adaption to the FBA consensus topology.

As a consensus topology, FBA accomplishes safety without depending on economic incentives, which might conflict with high-value and high-risk use-cases. The Flare Network makes use of the Ethereum Virtual Machine (EVM), allowing it to perform Turing complete smart contracts. A special Flare Virtual Machine, almost identical to EVM, converts complex smart contract codes into manageable instructions. Thus creating a decentralized applications ecosystem.

What is Spark?

Spark is the native token of the Flare Network cryptocurrency ecosystem, which is necessary for functioning smart contracts for XRP, but on a different network. The Ethereum blockchain ecosystem, for example, also has smart contracts, but they function within the blockchain itself.

Flare Network benefits

A significant portion of the value in blockchain networks cannot presently be used in a trustless way via smart contracts. According to the project, smart contract systems based on the Proof-of-Stake (PoS) consensus mechanism or its derivatives (e.g., DPoS) would suffer serious security challenges in the future.

The safety of PoS-based networks is derived from their native tokens, according to the Flare team. In this case, they adopt a procedure in which validators store bitcoin in their wallets in order to validate transactions and blocks in return for staking rewards. While this keeps the network secure, it does not provide safe alternative use-cases.

Assume that lending ETH via a DeFi protocol gives a 30% annual percentage return (APY) while staking the same token only offers a 5% APY. In such instances, most customers would choose the first option because it offers far higher rewards

Flare Finance ecosystem

Flare Finance has to be the most obvious answer to where to buy Flare token crypto. Launching together with Flare Network, it will become the first decentralized DeFi platform for XRP owners. A unique governance structure will create an ecosystem where every holder has input in its future. This project is unique compared to alternatives because it provides a list of financial products/tools:

FlareX

FlareX allows Flare Network users to trade currencies and earn passive income by supplying liquidity. It’s a typical decentralized exchange leveraging liquidity pools and an automated market-making model. The community can use FlareX to stake some tokens and make passive income on their stake.

FlareWrap

Flare wrap is a bridging solution to cut off excessive transactions and fees. It simplifies bridging to the Flare Network. By avoiding the exchanging process for many currencies, FlareWrap allows users to make extra money.

FlareFarm

Community members can generate yield by several stacking pools. For example, users can stake XRP and other available currencies to make passive income.

FlareMine

A decentralized mining pool where users can leverage their computing capabilities to mine Bitcoin and Ethereum. The platform automatically turns earned tokens into FLR (Spark), so users can earn interest on the native tokens.

FlareLoans

A platform for decentralized loans. The main requirement of issuing the loan is 120% of collateral, which will be used to repay the loan in terms of any delays. Compared to other platforms, the collateral is pretty low. For example, a Compound requires 150% or more for collateral. Synthetix crypto platform won’t approve collateral lower than 500% for some assets.

FlareMutual

FlareMutual makes it possible to secure the projects based on Flare Network. If any project has breaches and malfunctions due to a poor-designed smart contract, FlareMutual is a way to protect the project. Share the risk with other users by paying them a share of the yield.

After the launch of Flare Network, Flare Finance has three types of its tokens based on the Flare network coin. Users need the derivatives for managing the projects, paying commissions, and distributing fees. Here is essential information related to tokens:

- YieldFlare (YFLR). The key token of Flare Finance that will be used in all the mentioned DeFi services. However, its primary function is paying commissions. It is also crucial for governance as 1 YFLR is equal to 1 vote when choosing the updates of the structure. Flare Finance will issue 110 million YieldFlare tokens in total.

- YieldFin (YFIN). The critical function of this token is governance. One YFIN token is equal to 10,000 votes. Once used for voting, they will not disappear. The total amount of YieldFin tokens is 11,000.

- YieldMine (YMIN). The platform will use this token to reward users that provide their computing power on the FlairMine product. Flare Finance can give out up to 100,000 of them daily, and there are no limits on the total amount.

What are Spark tokens, and how do they work?

Spark is the Flare Network's native token, aimed to provide smart contract capability similar to XRP but on a different blockchain. As a native Flare blockchain cryptocurrency, Spark is collateral to issue different F-assets within decentralized applications. Spark also provides data provision, governance, and spam prevention leveraging transaction fees within the Flare network. For example, users can vote on the prices of F-assets in the FTSO. You can check the official website featuring the list of Flare supporting exchanges.

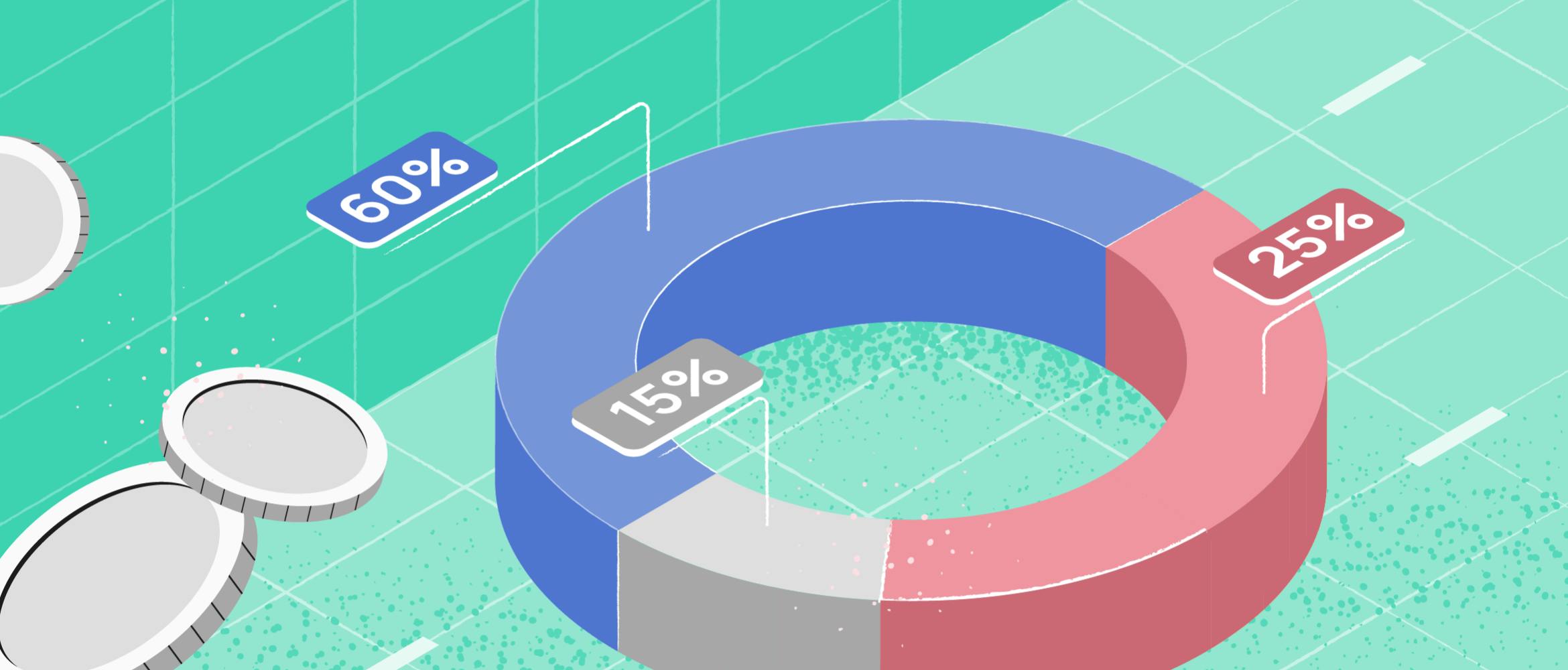

The initial supply of FLR is 100 billion tokens. Flare network dedicated 45% of the total supply to eligible owners of XRP crypto except for the wallets with the address of Ripple Labs. The conditions include accruing Spark at a 1:1 ratio, but the chances of the ratio being closer to 2:1 are pretty high.

Flare network Spark token price

At the moment of writing the article, FLR coin crypto price flats around $0.76 per token. You can see a detailed 30-day price chart below.

Flare network and Ripple (XRP)

Flare Network is a distributed blockchain network that uses the Federated Byzantine Agreement-based (FBA) Avalanche consensus process.

Unlike the XRP Ledger (XRPL), Flare incorporates the Ethereum Virtual Machine (EVM) and enables smart contracts natively. Most significantly, Flare may interact with other chains to extend the functionality of their networks and native currencies, such as through incorporating smart contracts.

Flare is useful for Ripple because it can serve as a bridge between the XRP Ledger and a smart contract platform such as Ethereum. As a result, XRP will have smart contract capability, allowing it to be used for dApps, DeFi solutions, and NFTs.

FXRP coin and nature of F-assets

FXRP is one of 4 F-assets available on the Flare Network. By definition, it’s just a representation of an XRP cryptocurrency on the mentioned network. Bringing one of the cryptocurrencies (XRP, XLM, DOGO, or LTC) to the Flare is possible due to the process of minting.

For example, any XRP holder (originator) can use FXRP to transmit the cryptocurrency to a group of addresses (agents) on Ripple's network. Smart contracts will be used by agents to mint the originating FXRP on Flare. The freshly created FXRP has a 1:1 value peg with XRP and is secured by Spark tokens.

When a user exchanges FXRP for XRP, he returns the previous token to the Flare smart contract. Then, agents send the same amount of XRP to the user's address on the XRP Ledger. If the agents fail to transmit the XRP to the user within a certain time frame, the network will reward him for the value of his XRP holdings as well as an additional quantity of coins to cover the transaction costs for repurchasing the digital asset.

The most crucial characteristic of FXRP and other interoperability protocols built on Flare is that the entire process of bridging two chains (and moving the native token of one to the other) is decentralized.

After minting tokens, the agents' Spark is locked away in a smart spark FLR contract. When an originator exchanges their FXRP for XRP, the network returns the agent's collateral to him. Originators pay a creation fee to agents in XRP in return for providing collateral for token minting, which incentivizes the latter parties to sustain the network. Flare, on the other hand, punishes agents for negative behavior.

When an originator converts FXRP to XRP, the network grants the agent two deadlines. If he only meets the second deadline and not the first, he receives his collateral back with a minor penalty cost. If the agent fails to meet the second deadline, Flare will consider it a redemption failure, in which the network burns half of his Spark collateral and returns the other half to him. Simultaneously, the originator earns 1% more after redeeming his XRP to offset the expenses of token buybacks.

Closing thoughts

Flare combines the value of non-Turing complete coins with the transformational potential of smart contracts on a network that can scale in terms of both value and transaction throughput. If the article was helpful and you want to discover even more info like this, check out our academy section.

Flare in 2025: Oracle Power for Automated Systems

By 2025, Flare Network has evolved into one of the most reliable decentralized data layers for ai crypto trading bots. Built to integrate off-chain and cross-chain data securely, Flare now powers decision-making for thousands of automated crypto trading bots relying on live information to adjust strategy parameters mid-cycle.

For traders operating bot signal trading setups across multi-asset portfolios, Flare’s high-frequency data access allows signal engines to track network-specific metrics like gas fees, liquidity depth, and governance activity. This has positioned Spark (FLR) not just as a utility token but as an infrastructural asset within the crypto bot trading ecosystem.

More sophisticated bots—particularly those deployed by funds or DAOs—now connect directly to Flare to fetch indicators like staking participation rates, cross-chain bridging volume, or even NFT sales metrics. These are then used to calibrate trade entries or pause execution entirely if predefined ecosystem conditions are triggered.

The integration of Flare’s APIs into tools like 3Commas further solidifies its role in enabling smarter, AI-augmented automation. As automated trading bots become more intelligent, the importance of trusted, low-latency data like that offered by Flare will only grow.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.