- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

How to build a well-balanced crypto portfolio?

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Embarking on your cryptocurrency investment journey in 2023? It's imperative to grasp the nuances of trading. Without this foundational knowledge, the market will impart its lessons, often accompanied by steep costs. Whether you're a novice dipping your toes or an experienced investor, crafting a balanced portfolio is paramount to risk mitigation. In this guide, we'll unravel the art of curating a harmonized crypto portfolio, paving the way for consistent returns.

What is a crypto portfolio?

A cryptocurrency portfolio is a systematic aggregation of cryptocurrency assets in volumes and proportions that correspond to investment plans or expectations. The main task of the crypto portfolio is to provide the investor with the maximum return on investment with minimum risks.

Why create a crypto portfolio?

The creation of a crypto-portfolio is an approach that allows you to neutralize the impact of the high volatility of crypto assets. Price fluctuations in the rates of even the most powerful cryptocurrencies sometimes reach 50% per day. Such spikes provide not only great prospects for receiving dividends, but also carry significant risks for investors.

When reaching the best crypto portfolio allocation, an investor can diversify risks and manage capital to achieve investment goals. You need to remember that no matter how stable the value of coins is, it will always fluctuate, and only the correct distribution of investments will make your funds resistant to fluctuations.

A portfolio will be useful even with insignificant investments. You can choose young coins and projects that bring XXX returns to early birds. Everything depends on your goals and budget.

How to create a crypto portfolio?

There are thousands of cryptocurrencies in existence today, but not all of them are worth investing in. The main principle of the correct distribution of assets is cryptocurrency diversification. As they say, ‘don’t keep all eggs in one basket’.

Investing in a single cryptocurrency, even the most reliable one, is very risky because if the exchange rate collapses, the investor risks losing everything at once. “Should I diversify my cryptocurrency savings?” - newbies ask. Sure! A crypto portfolio must contain a variety of cryptocurrencies in the right proportions for profitability and risk mitigation.

Compare:

Investing in one cryptocurrency | Diversifying investment |

|---|---|

You’ve bought one coin and waited for it to grow in price. Suddenly, it drops by 20% - you lose 20%. The lower it keeps going, the more you lose. | The same cryptocurrency drops 20%. But you have the other two growing by 15%, and that saves you from losses. You can survive through the fall of the first asset. |

As a rule, the biggest part of the portfolio should consist of popular cryptocurrencies with stable growth and capitalization. But there are also alternative strategies aimed at making significant profits with considerable risks.

Asset selection

When choosing coins to invest in, the following criteria should be highlighted:

- price;

- capitalization;

- popularity;

- volatility;

- perspectives.

Investments in assets from the top-20 can be considered relatively reliable. These currencies have more stable exchange rates, high liquidity and nice growth prospects. But when choosing investments in such giants as Bitcoin (BTC) and Ethereum (ETH), you should not expect rapid growth in their value. They should form some part of your balanced crypto portfolio.

New projects have good prospects in terms of profitability, sometimes even thousands of percent, if things go well. But the risks of financial investments in startups are also great. Recently, the most interesting and promising coins have been related to the DeFi and NFT games. The capitalization of these industries is growing at a rapid pace. Many projects are created to ensure the successful development of the new economy.

The most promising coins are the blockchains’ native coins, for example, Polkadot (DOT), Solana (SOL), Cardano (ADA) and others. These currencies are very liquid and gain huge volumes. A good sample of a crypto portfolio would include those.

The return on investment depends on the value of the assets at the time of acquisition. If you bought during the period of the best market performance, there is a high risk of a correction. Buying on highs means you will have to wait for some time for the investment to pay off. Therefore, it is worth paying attention to assets that look undervalued.

The cryptocurrency portfolio needs to be constantly changed taking into account the current market situation. That’s called rebalance or reinvestment. Some of the assets are gradually leaving the market or losing positions and new, promising and profitable ones come to replace them. A cryptocurrency investor should stay tuned to the market and be aware of trends, events and innovations at all times.

Choosing a strategy

How to diversify a crypto portfolio? When creating a cryptocurrency portfolio, an investor needs to focus on those strategies that better meet his financial expectations. Such strategies differ by the number of investments, the degree of risk and timelines. Here are a couple of simple portfolio asset allocation schemes.

For careful low-risk investment, you should combine:

- 80% - coins from the top 15 cryptocurrency ratings;

- 15% - altcoins with high liquidity and popularity;

- 5% - coins of promising projects with low cost.

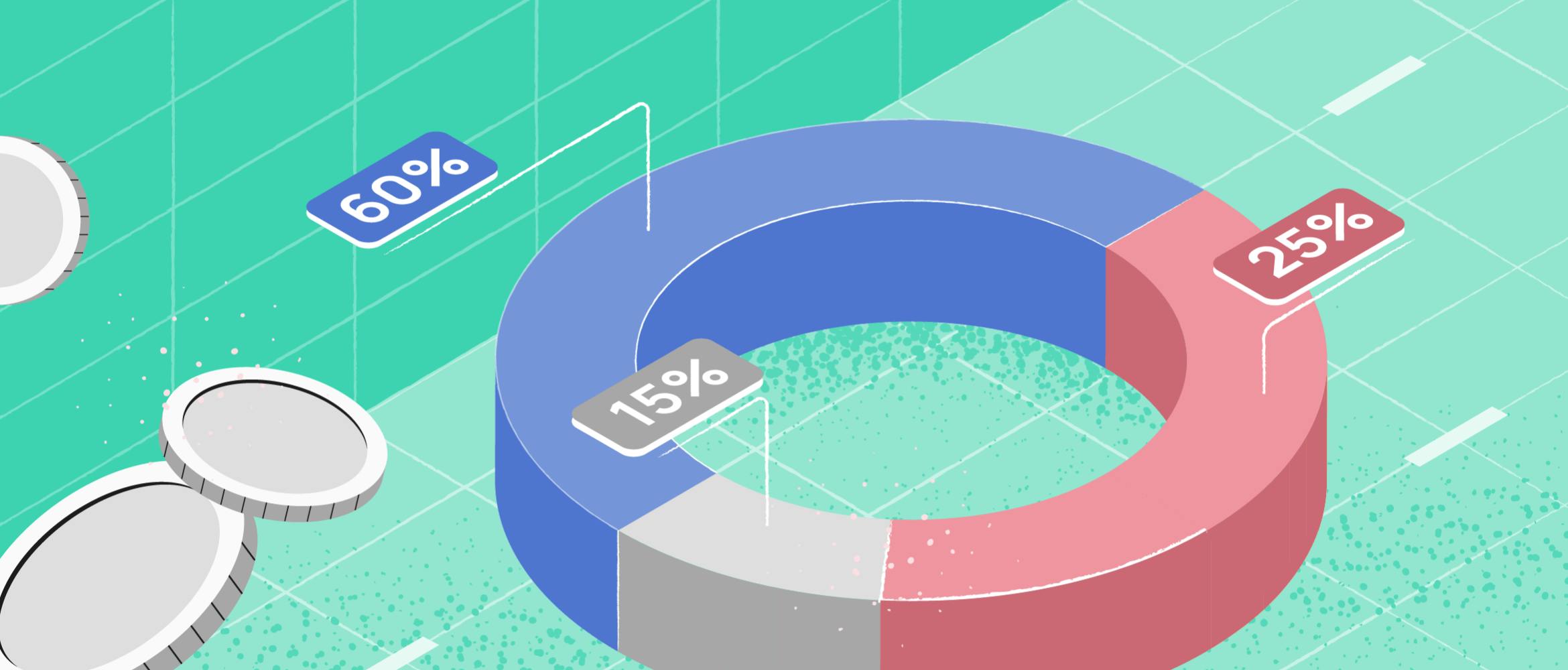

For more risky investments, you can include coins from projects that are just entering the market. “What should my crypto portfolio look like with such an approach?” - many starting traders wonder. Such assets require increased attention but can bring impressive income with minimal investments. In this case, the assets should be divided according to the following principle:

- 60% - major cryptocurrencies;

- 25% - popular altcoins with growth prospects;

- 15% - new altcoins.

As for the percentage of portfolio in crypto, it can be even 100%. Some people don’t deal with stocks and fiat at all.

Where to store your crypto portfolio?

A cryptocurrency exchange is the easiest and most affordable way to form a cryptocurrency portfolio. There you can trade assets through a terminal, get an insight into your portfolio, check losses and profits, and perform various transactions. Intuitive interfaces will help you monitor the coins’ value, trends, trading volumes and other useful information.

This option is suitable for investors who prefer a dynamic approach and keep rebalancing their portfolios quickly. On an exchange, they can diversify their portfolio by selling unprofitable and acquiring growing assets.

The major disadvantage of storing cryptocurrency on an exchange is its unreliability. Most exchanges keep the keys to their wallets, so they own all the assets. Exchanges can be hacked or closed suddenly. Therefore, hardware wallets are the best for secure long-term storage.

Top portfolio trackers

How to track your crypto portfolio? Here are the platforms where you can perform accounting and keep tabs on your investments.

- Blockfolio. Popular cryptocurrency portfolio for iOS and Android devices.

- Delta. A very user-friendly portfolio, a direct competitor to Blockfolio. The app is available on all platforms: iOS, Android, Windows PC, Mac Os and Linux.

- Cryptocompare. A crypto asset tracker where you can monitor all markets in real time and discuss the latest trends in crypto and cryptocurrency markets. It’s a portfolio manager with a wide range of tools to manage your crypto assets.

- Cryptotrackr. A minimalistic crypto portfolio to track your coins. A great option for starters.

- Coin Tracking. The service analyzes your transactions and generates reports on profit and loss, the value of your coins realized and unrealized profits, tax reports and much more.

- Altpocket. A reliable service for viewing the value of your crypto assets and calculating profits.

- Coinfolium. A service for quickly creating a portfolio of cryptocurrencies without registration and waste of time.

- Coin.fyi. Service for tracking your crypto portfolio + market cap and news.

- Crypto Portfolio Tracker. Use it to connect your accounts and fetch the real-time information about your profit or loss. The tracker can be connected via API.

- CoinMarketCap. This altcoin portfolio tracker covers the largest database of cryptocurrencies. You can keep track of your portfolio both online on the website and using a mobile application.

- CoinGecko Portfolio. The platform has also added to its functionality the ability to track your purchased cryptocurrencies. The portfolio can be maintained both on the website and in a convenient mobile application.

Bitcoin vs altcoins

Many crypto traders prefer to invest in Bitcoins only. The reasons are clear:

- Bitcoin is the first successful cryptocurrency in the world and has an impressive market share.

- Due to Bitcoin dominance, market volatility is often associated precisely with fluctuations in the BTC rate.

- Bitcoin is one of the most reliable digital currencies. Most analysts agree that Bitcoin is less likely to crash than altcoins.

When chosen correctly, altcoins can be powerful investment tools, as well. However, it’s crucial to pick some well-established currencies and manage risks. When you deal with altcoins, rebalancing is vital. Poorly managed cryptocurrencies and scams can crash and devalue overnight, so don’t opt for ‘get-rich-quick’ projects.

If you want to form your cryptocurrency portfolio like a pro, you need to understand how the ratio of the total emission and the number of tokens in circulation will affect the market value of the asset you are interested in. It's just a matter of supply and demand. The more demand, the higher the price. If demand exceeds supply, the price will always rise. Even with strong demand, the price of a cryptocurrency is unlikely to rise much if there is a large supply.

Attention to decentralized platforms

Decentralized projects are gaining traction because they are controlled by the community, not a central party. That raises the audience's trust. DEXs are open-source projects and most of them can be checked in the Github service.

Decentralized platforms are the backbone of the cryptocurrency market, and many believe that the entire philosophy of the crypto space is built on the idea of decentralization. That’s why some traders’ crypto portfolio strategies are based on DEX coins only.

Decentralization also has its drawbacks that you need to consider when building a reliable crypto portfolio:

- You have no one to claim damages from if you were deceived by scammers or you accidentally sent your money to the wrong address. If you are dealing with decentralized cryptocurrencies such as Bitcoin, blockchain mistakes can be costly.

- Decentralized projects based on the Ethereum network are currently harshly criticized because of crazy fees.

Mind to rate the project

How to avoid mistakes when you’re searching for decent coins to add to your portfolio? Read the White Paper of the project you want to invest in. Avoid investing in projects with anonymous creators - it’s very likely to be a scam. Lack of background information about the team and founders is a bad signal, so build your portfolio with more transparent assets.

Signs of promising coins:

- Open-source codes and audited smart contracts.

- A lot of information about the team.

- Clear and ample Whitepaper.

- Regular activity in social networks.

Bottom Line

A cryptocurrency portfolio allows an investor to allocate and use their capital as efficiently as possible. By following a personalized, well-tested crypto portfolio strategy, an investor reduces the risks associated with the high volatility of digital assets and enjoys a maximum increase in dividends.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.