- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Margin Trading Bitcoin: Things to Know About Crypto Margin Trading

If you are keen to learn more about the crypto margin trading concept or how bitcoin margin works, you’re at the right place. This article elaborates on what margin trading bitcoin is, touches on how margin trading works, and also reviews various crypto margin trading platforms for you.

- Crypto Margin Trading Explained

- How Does Crypto Margin Trading Work?

- Types of Crypto Margin Trading

- What Are the Fees Related to Crypto Margin Trading?

- Best Crypto Margin Trading Platforms

- Binance Margin Trading

- Pros Of Binance Margin Trading

- Cons of Binance Margin Trading

- Bityard Margin Trading

- Pros Of Bityard Margin Trading

- Isolated Trading

- Leverage At Bityard

- Bityard Fees

- Cons of Bityard Margin Trading

- Kraken Margin Trading

- Pros Of Kraken Margin Trading

- Kraken Margin Trading

- Cons Of Kraken Margin

- BitMEX Margin Trading

- Pros Of BitMEX Margin Trading

- BitMEX Margin Trading

- Cons of BitMEX Margin

- Poloniex Margin Trading

- Pros Of Poloniex Margin Trading

- Poloniex Margin Trading

- Cons Of Poloniex Margin Trading

- Crypto Margin Trading Pros and Cons

- Best Cryptocurrency & Bitcoin Margin Trading Tips

- Is Crypto Margin Trading Safe? The Risks Of Bitcoin Margin Trading

- 2025 Outlook: Bitcoin Margin Trading Trends and Professional Tools

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Crypto Margin Trading Explained

Cryptocurrency margin trading is a form of crypto trading where you borrow funds to maximize potential profits. You can borrow either from other traders, a crypto broker, or an exchange directly. The borrowed amount is provided against the assets available to the trader.

Another name for margin trading is trading with the use of leverage. An obligatory condition for opening a transaction using the broker's borrowed funds is the availability on account of a certain part of funds from the total sum of the transaction.

Margin is a deposit blocked by the crypto broker on the trader's account at the moment of transaction opening. As a rule, the margin is expressed as a percentage, for example, margin requirement of 20% means the possibility to open a deal with financial instruments with 1/5 of their total value on the account.

The amount of margin or leverage depends on the specific financial instrument and is determined by the exchange risk rate. For the cryptocurrency trader, margin trading is an opportunity to open transactions in various instruments, the value exceeding the possibilities of his trading account by several times.

What Is Bitcoin Margin Trading?

Bitcoin margin trading is buying and selling crypto assets to make money on price fluctuations. Only in this case, you borrow additional funds from the cryptocurrency exchange on top of your own investment to increase the trading volume. Accordingly, you get a chance to make more substantial profits.

Your funds to borrowed funds ratio is called leverage. Leverage is not the same as a loan. The risk here is that your personal funds will go bust. It is a delusion to think that if your prediction didn't work out and the position went into a loss, you will remain indebted to the exchange.

Because the mechanics here are different from the banking mechanics. The leverage of the exchange essentially only increases the volume of the order. In practice, it is your funds that are rolled over, and in the event of a losing position, they go bust. But at the moment when the asset on the order comes to an end, we notify about it with a margin call, allowing you to add funds, or close the position before it is too late", - explained in the customer support of the exchange WhiteBIT.

For example, you have 10,000 USDT in your account. Your solution is to go long (buy for the future) bitcoin, hoping that the price of the asset will later rise and you can sell and make money on the difference. With x5 leverage, you can buy Bitcoin for 50,000 USDT rather than 10,000.

But the situation has changed, and the asset, on the contrary, began to fall in price. When the exchange calculates that your 10,000 USDT is about to expire, it notifies you with a margin call (a message that the position is unprofitable). Or it pulls up funds from your margin balance specifically for that case, and then sends a margin call (depending on the type of leverage, there will be a separate section on that).

How Does Crypto Margin Trading Work?

Archimedes once said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” It was nothing less than the concept of a physical lever, which, given the right fulcrum and the right length, can overturn a car, or anything else. It's quite simple: the longer the lever, the more force it provides.

The leverage principle works in finance just as it does in physics — you can do more and, most importantly, more easily with it. Financial leverage is the ratio of a trader's money to the total amount of money he trades. In other words, it is a service of the exchange that provides funds that are several times greater than its own. The use of leverage allows you to get more income.

Leverage allows a trader to make trades worth much more than his own account equity. Let's look at a simple example. You're a novice investor and decide you can't spend more than $1,000 on asset transactions in the market. But suddenly you discover a pretty good strategy and you need $20,000 to trade a portfolio of securities. You borrow the missing money from the exchange or another trader through the exchange - you get 1:20 leverage.

Of course, the exchange wants to protect your money, and in the automated trading system it sets the threshold for loss on a deal, equal to the amount of your pledge / the amount of your account - $1,000. That is, if during operations on the stock market you suddenly incur losses, they will never exceed $1000 - you will lose your money, and the broker, risking nothing, will return your money.

This is quite true, and such situation is called margin call - an unprofitable position, threatening you with losses, is closed (sometimes even without prior notification). And if operations on the market are profitable, then all of the profit is left to you, and the broker gets back only his credit funds. For example, you bought $20,000 worth of stock, it rose sharply, and you made as much as $3,000 in profit. All $3,000 ($1,000 deposit) is yours.

The broker will simply take his $19,000. Obviously, if you had $1,000 of your own money, you would never make $3,000 of profit, and that is the point of leverage. Be careful: a margin call does not only refer to your collateral, but to the entire amount of your account — that is what you are risking, but in our example, these amounts are equal.

Here’s how margin trading works on practice:

- Fund your exchange wallet, and activate margin trading account

- Take a leverage using your funds deposited as a collateral

- Once your position is opened, you’ll pay an interest rate unless the position is closed, you run out of funds, or a margin call happens.

How Crypto Margin Trading Is Funded?

Once you understand what margin trading Bitcoin is, let’s address some underpinning aspects like how the account is funded. Margin trading is a widespread practice. It is professional traders who turn to it more often. In this regard, trading floors need to provide large volumes of coins. That's why they develop their products and choose approaches to provide assets to everyone who wants to take leverage.

Of the most widely practiced:

Funding wallets: Such a service, for example, is offered by Bitfinex. By opening a special account on the cryptocurrency exchange, the trader has the ability to lend funds to other users through a peer-to-peer funding platform (more details at the link). The trader also has the right to set the term of the loan, the interest rate and the amount. The minimum amount to lend is $150 or the equivalent.

Fixed deposit plans: For example, WhiteBIT [Smart Staking]. A trader can leave some amount of money for a period of 10 days to a year at an interest. Let's say, 1 bitcoin left for 3 months will give 6% profit — that is, 0.06 BTC on top. Accordingly, at that time, the exchange adds assets to its liquidity. That's why the interest is so high here. The minimum deposit amount here is more comfortable - $50.

Types of Crypto Margin Trading

There are two types of margin trading: isolated and cross-margin. Some platforms offer both types. Some offer only one.

What is Margin Trading Bitcoin — Margin, Isolated, Cross Margin Account

It’s an account on the user's account, which contains funds for trading with leverage. In order to use it you must transfer funds from your overall balance into it. Isolated — is the one with one trading pair, cross-margin — is the one that can have several trading pairs.

Accordingly, a trading pair is a pair of assets (can be crypto/crypto, fiat/crypto, crypto/fiat) in which A is the asset you plan to trade, B is the asset you want to sell or buy it for. For example, in a BTC/USDT pair, you either sell Bitcoin for USDT or buy Bitcoin for USDT. In an ETH - BTC pair, you buy or sell Ether for USDT and so on.

What is Margin Trading Bitcoin — Trading Isolated Margin Trading

Trading isolated margin implies funds for a trade are pulled from an isolated margin account. When the funds in that account come to an end, the position can be liquidated. Other funds that are in your general balance are not pulled. Even if you have several isolated accounts open.

Position liquidation: This is the forced closing of your position by a cryptocurrency exchange when the liquidation price is reached. It occurs when a critical amount of margin in the trader's account has been overcome. It differs across exchanges.

On a cross-margin exchange, the user opens a margin account where he can add different assets. Accordingly, if necessary, the funds that are on this balance can be "pulled up" to the order. This is a convenient tool in case volatility surges. If the position becomes unprofitable, the cryptocurrency exchange does not rush to liquidate it, but adds funds, prolonging the life of the position. Thus, a margin call comes later, and the trader's position gets a better chance of success. That is why this type of margin trading is more in demand.

What Are the Fees Related to Crypto Margin Trading?

Crypto margin trading comes with several fees to consider before getting started.

- Bitcoin margin trading opening fee. A one-time fee to open a trading position

- Bitcoin margin trading Interest rate. The funding fee you pay as long as the position is opened

While the opening fee is pretty straightforward, interest rate is the premium between spot and futures market. If basically pay the difference between the two to keep your position opened. The Bitcoin margin trading rate is calculated automatically once an hour.

Other Crypto Margin Trading Fees

Commissions on margin trading vary. Some go only to the exchange, some go to the borrower who lends through the cryptocurrency exchange:

- Bitcoin margin trading funding exchange — basic type, daily commission for using leverage (from 0.01% per day);

- Bitcoin margin trading rollover exchange — commission for the additional activity of the trader's position (from 0.01-0.02% for 4 hours).

- Bitcoin margin trading Peer to Peer fees. In this case, the exchange does not act as a borrower, but only as a platform for placement of an appropriate proposal. You pay the user, who lends you the assets, and the exchange collects its own interest from the funds earned by him (from 15%-18%).

What is Margin Trading Bitcoin: Isolated Margin Trading and Cross Margin Trading

Before we go any further toward the best Bitcoin margin trading platforms of 2022, let’s get our feet wet at the concept of margin trading, the difference between various types of margin trading, and across markets.

Cross Margin & Isolated Margin Under 30 seconds

- Crypto cross margin is Bitcoin margin trading that is allocated to an open position using the full amount of funds in the available balance, which reduces the risk of liquidation of a losing position.

- Crypto isolated margin is Bitcoin margin trading individually allocated to an outstanding margin position with a fixed amount of collateral.

What Is Isolated Margin Trading?

Isolated margin is a tool, which implies the possibility to isolate the margin that provides some transactions from the margin of other transactions. The simplest example of realization of this possibility is trading on two or more independent from each other trading accounts within one user account. In this way the margin between accounts will be isolated, i.e. a loss on one account will not lead to a change in the balance on the other account.

For example, you opened two accounts: one for short-term strategy, and one for long-term positions. Let's imagine that the account with the short-term positions has gone strongly into deficit, but trading on the account with the longer-term positions is going very well. Isolated margin between individual trading accounts implies that profits in the more successful account will not be "eaten up" by losses in the less successful account. Also, this tool allows traders to control the profit/loss within trading strategies tied to different accounts.

What Is Cross Margin Trading?

The meaning of cross margin is that the entire balance provides positions. The algorithm for this tool is very simple: on any trading account, trades exist as long as the minimum margin requirement is met. Loss-making positions reduce the margin level, while profitable ones, on the contrary, increase it. In cross-margining, winning one position helps meet the margin requirements of another position.

Of course, if there is a loss on all positions and the margin level falls below the platform's set level, trades will be closed automatically, i.e. liquidated. This occurs in order to avoid uncontrollable losses of the user and the platform. However, in cases where some of the trades are profitable cross margin becomes a very useful tool because it allows in many cases to survive the minus and eventually turn unprofitable positions into profitable ones or go to breakeven.

Crypto Spot Trading | Crypto Margin Trading |

Less risky, less profits | Riskier and more profitable |

No need for collateral, you trade instantly using your own funds | Requires collateral also known as margin, borrow the money from a third party |

Safer for newbies | Advanced traders |

Best Crypto Margin Trading Platforms

Let’s quickly address various margin trading platforms to access as many crypto margin tools as possible. Here’s the list of 5 margin exchanges you can use along with 3Commas trading bots for maximum margin benefits.

Binance Margin Trading

Bitcoin margin trading at Binance is a popular way to trade BTC and other crypto assets. The exchange offers competitive fees, high liquidity, and a wide range of assets supported on the margin market. You can also hold BNB tokens to save on trading commissions.

Pros Of Binance Margin Trading

- Various various margin trading tools, including isolated margin trading & cross margin trading

- No deposit fees for various crypto margin pairs

- Margin tools like levels and maintenance

- Up to 3x leverage for BTC and other assets

Cons of Binance Margin Trading

- Fairly complicated trading Bitcoin platform for newbie traders

- Margin trade cryptocurrency orders are connected to spot market

Bityard Margin Trading

Bityard is a crypto margin trading platform based in Singapore. It’s known for advanced margin trading features available in 150 countries worldwide.

Pros Of Bityard Margin Trading

- Isolated margin trading account

- Fairly low trading fees

- Intuitive and highly customizable margin trading interface

- Various crypto margin trading strategies available

Isolated Trading

On Bityard, you can trade with leverage without additional risk exposure to your entire account. Instead, your margin is separated and doesn’t affect the rest of the funds. In case of margin call [liquidation], your funds will only be deducted from the margin account.

Leverage At Bityard

You can get a leverage of up to 1:125 [125x] on crypto margin trading and up to 1:200 [200x] on derivative margin. Such a huge leverage isn’t quite popular among exchanges, which is another feature of Bityard.

Bityard Fees

For each position opened on Bityard, you pay an opening fee. Here’s the formula to calculate the fee to be paid.

[Opening/Closing fee = Margin * Leverage * 0.05%]

Cons of Bityard Margin Trading

- There’s a minimum deposit

- Over the counter [OTC] deposits aren’t available in some countries

Kraken Margin Trading

Kraken is a major crypto exchange based in the US. The exchange operates in over 175 countries worldwide and supports various margin trading tools in most countries.

Pros Of Kraken Margin Trading

- Intuitive user interface

- One of a few crypto margin exchanges in the US

- Low fees on leveraged trading

- Bitcoin platform with various crypto margin trading strategies

Kraken Margin Trading

Kraken allows you to open long and short margin positions to trade crypto with a leverage as high as x5. While some other exchanges may offer a higher leverage ratio, Kraken supports multiple features you can combine with relatively conservative leverage to keep the profit flow steady.

Cons Of Kraken Margin

- Provides maximum leverage of only 5x

- Slow verification process

BitMEX Margin Trading

BitMEX is one of the industry leaders when it comes to margin trading. The backing company is based in Seychelles, which resolves pretty much all legal questions related to leveraged trading regulation. It’s a fast and secure platform to trade a wide range of crypto assets using leverage. You can also access swaps and futures here.

Pros Of BitMEX Margin Trading

- A reputable margin trading Bitcoin platform

- High leverage and liquidity

- Reasonable fees for Bitcoin marginal trading

- Supports anonymity

- No fees on deposits or withdrawal

BitMEX Margin Trading

BitMex isolated margin trading feature is designed to protect your account from extra losses. Imagine you have 200 USDT on your account, and you’re using a 5x leverage. In case of any significant market fluctuations, you risk losing your whole deposit stored within the account. Isolated margin limits the exposure, reducing the overall risks associated with liquidation.

Cons of BitMEX Margin

- Outdated user interface

- Exchange is alleged to be involved in illegal activities

Poloniex Margin Trading

Yet another crypto exchange based in Seychelles. This margin trading platform allows you to trade, invest, stake, lend, and much more. According to the CoinMarketCap aggregator, Poloniex is among the most renowned exchanges you can opt for.

Pros Of Poloniex Margin Trading

- High liquidity

- No verification needed

- Chatbox feature

Poloniex Margin Trading

At Poloniex, your initial margin and maintenance margin levels determine your leverage, and you can get leverage up to 100X. It has a tier-based fee system, and you can also apply for the silver and gold tiers.

Cons Of Poloniex Margin Trading

- Was hacked back in 2014. Lost 12% of user assets

- High lending interest rates

Crypto Margin Trading Pros and Cons

Crypto Margin Trading Pros | Crypto Margin Trading Cons |

|

|

Best Cryptocurrency & Bitcoin Margin Trading Tips

Even though margin trading is risky you can still apply some tips to increase your chance for steady profits.

Start Crypto Margin Trading Slowly

Getting started with a small deposit may limit your profits, but also risks. If you’re entering margin trading over the long run, consider starting as small as possible before you learn more about the market.

Limit Your Crypto Margin Trading Exposure

Crypto margin trading forgives no all-ins. You may be lucky enough to make profits several times, but if you keep going all-in, you’ll lose your whole deposit eventually. Instead of using 100% of your balance going long/short on one asset, consider 5% per asset at a time.

Remember About High Volatility of Crypto Margin Trading

Crypto is a volatile market itself, but crypto margin trading is way more unpredictable. The things become even riskier when you’re using leverage. A relatively small leverage of 1:5 [x5] will cause a liquidation if your asset veers 20% off of the position.

Manage Risks Related to Crypto Margin Trading

Risk management is the key when trading crypto margin. If you don’t set specific rules you’re going to stick to, you risk running off the deposit. Once you apply the rules and stay disciplined, you’re more likely to make profits on such a rough market.

Is Crypto Margin Trading Safe? The Risks Of Bitcoin Margin Trading

Margin trading is a risky endeavor and the risk increases with higher volatility and leverage used. The higher the risk, the more the chances of a trader being liquidated — the industry parlance for being blown out off the position.

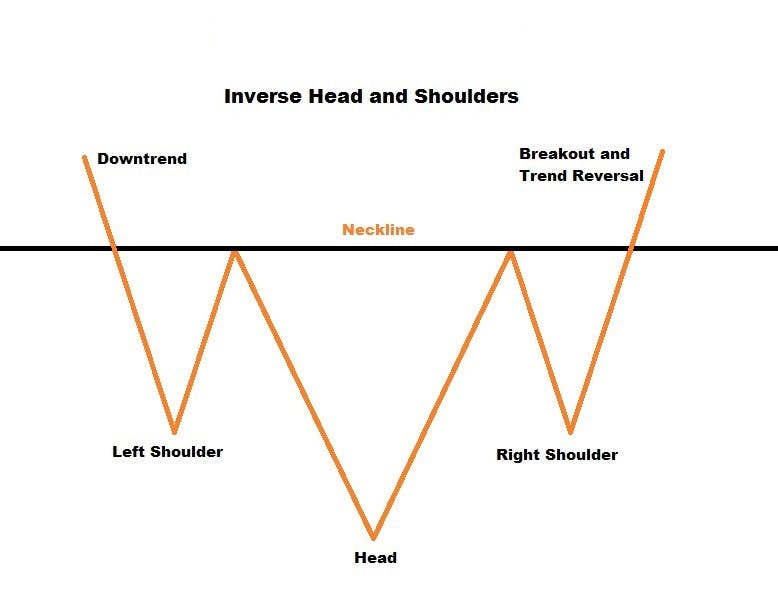

To manage risk, a majority of traders hedge their bets by opening opposing positions. It is a standard way to manage risk involved in the investment. For instance, if you hold a lot of Bitcoin, it would be seen as a long position. One of the ways to hedge against the volatility of downward price might be to place a leveraged short position. By doing this, the short position will rise if the price of Bitcoin falls, and the investors can recover some of their losses.

Only Few States in the US Allow Margin Trading

Even though 23 states in the US allow margin trading, the US residents can’t trade margin crypto. Even the margin-oriented crypto exchange Kraken doesn’t allow trading crypto with leverage in the US. Once users confirm they’re residents of the US, the margin trading restriction message pop-us.

What If I Use a VPN for Margin Trading?

VPN service won’t allow you to trade margin if you’re based in the US. All major exchanges operating within the US require you to pass the KYC procedure, which confirms your location. Once you pass KYC as a resident of the US, the exchange applies country-specific rules to your account regardless of where you are.

2025 Outlook: Bitcoin Margin Trading Trends and Professional Tools

Margin trading in 2025 continues to be a widely used strategy for high-volume traders and crypto-focused asset managers. However, the conditions and tools surrounding this practice have shifted significantly, particularly with the growing integration of automated crypto trading software and regulatory realignments.

Macro Shifts and Risk Exposure

Bitcoin’s recent price correction—dropping below $80,000 in April 2025 —has underscored the systemic risk exposure margin traders face. Liquidations across high-leverage positions reminded market participants that while leverage magnifies returns, it equally increases downside volatility.

Professional participants are responding by incorporating automated trading bots with advanced stop-loss logic and customizable liquidation alerts to minimize exposure. This is especially true among asset managers handling multiple client accounts under discretionary mandates.

Regulatory Adjustments in the U.S. and EU

An interesting event for compliance was that the U.S. Department of Justice disbanded its National Cryptocurrency Enforcement Team in April 2025 , marking a pivot away from punitive enforcement toward prioritizing cases involving national security and organized crime. Meanwhile, the European Securities and Markets Authority (ESMA) continues to evaluate the financial stability risks tied to margin lending and derivative exposure in digital assets.

Technology: Advanced AI Bots and Automation

A notable transformation is the integration of AI bot crypto trading tools and auto crypto trading bot platforms across margin-enabled exchanges. These tools support real-time portfolio rebalancing, client account segregation, and precision in multi-asset margin strategies.

Software providers like 3Commas have launched solutions tailored for institutional users, offering automated cryptocurrency trading bots that optimize leverage usage and dynamically manage open interest. Such features go beyond typical trading dashboards, addressing the operational requirements of funds overseeing diverse crypto portfolios.

Strategic Use of Altcoins in Margin Portfolios

While Bitcoin remains the dominant asset in leveraged trading, institutional desks are increasingly incorporating structured exposure to altcoins. The rise of altcoin trading bots—particularly those integrated with platforms like Binance—offers additional market depth and volatility-driven arbitrage potential. These bots facilitate split-margin deployment across correlated pairs, reducing directional risk.

Summary

As automated systems continue to gain traction, today's professional trader or fund manager benefits from a rapidly expanding toolkit. The interplay between ai cryptocurrency trading bots, refined regulatory clarity, and better risk modeling has positioned 2025 as a year of consolidation and infrastructure maturity in the crypto margin trading space. It’s no longer just about amplifying gains—it's about control, compliance, and strategic execution.

FAQ

Margin trading requires a separate wallet account on a crypto exchange. You can either send over some funds from the spot trading account or top-up margin account right away. Learn more about margin trading on Kraken.

Crypto margin trading might be a good idea for either experienced traders or traders with a high-risk tolerance. Such a trading style implies more profits and risks along the way — you can earn more but lose everything if trading recklessly.

Crypto margin trading works best on crypto with high liquidity. You may consider the top 50 major coins to start margin trading. Trading volume and recent price changes also affect the crypto margin trading experience.

Bitcoin margin trading is a specific trading style, implying leverage and borrowed money to increase potential profits. Bitcoin margin trading is riskier but also more rewarding compared to other trading styles. More of a visual learner? Check out a YouTuve video about what is margin trading Bitcoin on BitMEX

READ MORE

- Crypto Margin Trading Explained

- How Does Crypto Margin Trading Work?

- Types of Crypto Margin Trading

- What Are the Fees Related to Crypto Margin Trading?

- Best Crypto Margin Trading Platforms

- Binance Margin Trading

- Pros Of Binance Margin Trading

- Cons of Binance Margin Trading

- Bityard Margin Trading

- Pros Of Bityard Margin Trading

- Isolated Trading

- Leverage At Bityard

- Bityard Fees

- Cons of Bityard Margin Trading

- Kraken Margin Trading

- Pros Of Kraken Margin Trading

- Kraken Margin Trading

- Cons Of Kraken Margin

- BitMEX Margin Trading

- Pros Of BitMEX Margin Trading

- BitMEX Margin Trading

- Cons of BitMEX Margin

- Poloniex Margin Trading

- Pros Of Poloniex Margin Trading

- Poloniex Margin Trading

- Cons Of Poloniex Margin Trading

- Crypto Margin Trading Pros and Cons

- Best Cryptocurrency & Bitcoin Margin Trading Tips

- Is Crypto Margin Trading Safe? The Risks Of Bitcoin Margin Trading

- 2025 Outlook: Bitcoin Margin Trading Trends and Professional Tools