Meet the New 3Commas AI Assistant

Nov 24, 2025

Perp-style futures. Now live for US traders

Trade futures on Coinbase US with full bot support

BUSD (Binance USD) was discontinued in February 2024 and is no longer available for trading. All holdings were converted to FDUSD and other stablecoins. This page remains for historical reference only. For active stablecoin trading, explore our bots for FDUSD, USDT, or USDC instead.

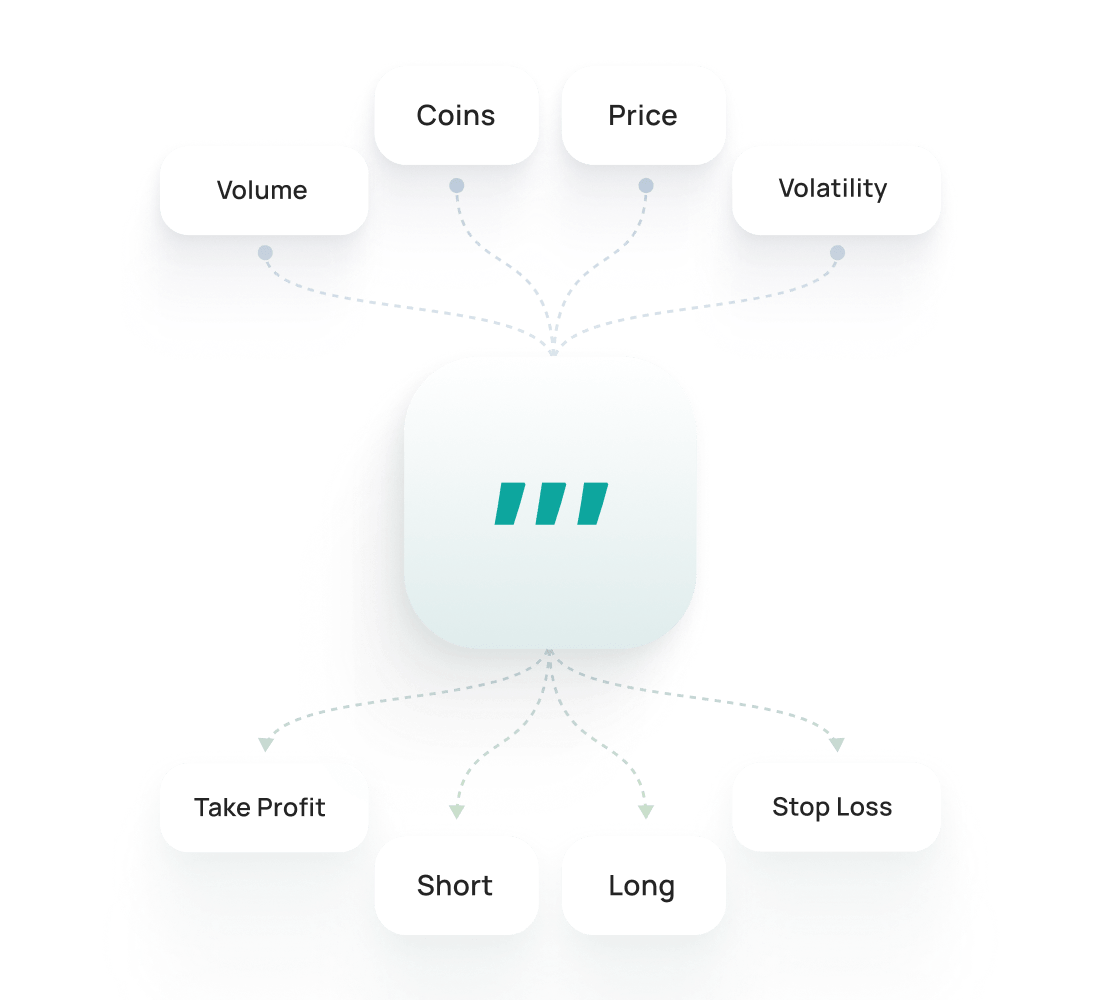

A Binance USD (BUSD) trading bot was an automated system that executed trades involving the BUSD stablecoin without human intervention. BUSD maintained a 1:1 peg with the US dollar, making it ideal for automated strategies like arbitrage on tiny price fluctuations or rebalancing portfolios between volatile cryptocurrencies and stable assets. Bots operated continuously, capitalizing on opportunities humans might miss while eliminating emotional decisions. With 3Commas, your funds stayed secure on your exchange through non-custodial technology. The platform only used API keys with trade permissions, never withdrawal access, so you maintained complete control of your assets.

Important Notice: Binance USD (BUSD) was discontinued in February 2024 following Paxos's cessation of new token minting in February 2023. This stablecoin is no longer actively supported for trading and has been replaced by alternative stablecoins on most major exchanges. The information below is maintained for historical reference only. Users seeking stablecoin trading strategies should consider currently supported alternatives such as FDUSD, USDT, or USDC.

Learn moreImportant Notice: Binance USD (BUSD) was discontinued in February 2024 following Paxos's cessation of new token minting in February 2023. This stablecoin is no longer actively supported for trading and has been replaced by alternative stablecoins on most major exchanges. The information below is maintained for historical reference only. Users seeking stablecoin trading strategies should consider currently supported alternatives such as FDUSD, USDT, or USDC.

Learn moreImportant Notice: Binance USD (BUSD) was discontinued in February 2024 following Paxos's cessation of new token minting in February 2023. This stablecoin is no longer actively supported for trading and has been replaced by alternative stablecoins on most major exchanges. The information below is maintained for historical reference only. Users seeking stablecoin trading strategies should consider currently supported alternatives such as FDUSD, USDT, or USDC.

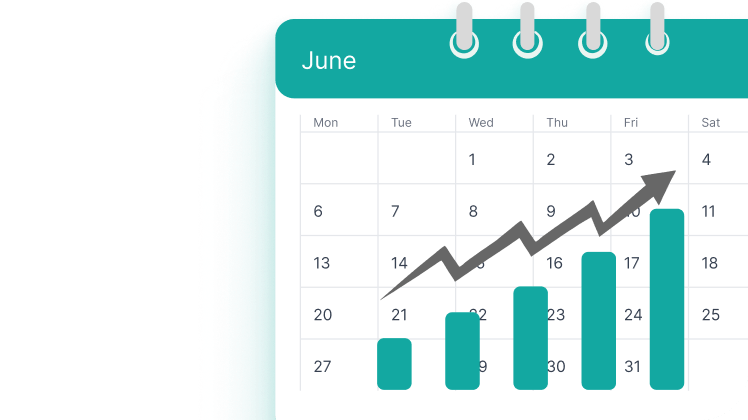

Learn moreThe Binance USD Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Binance USD SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Binance USD Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

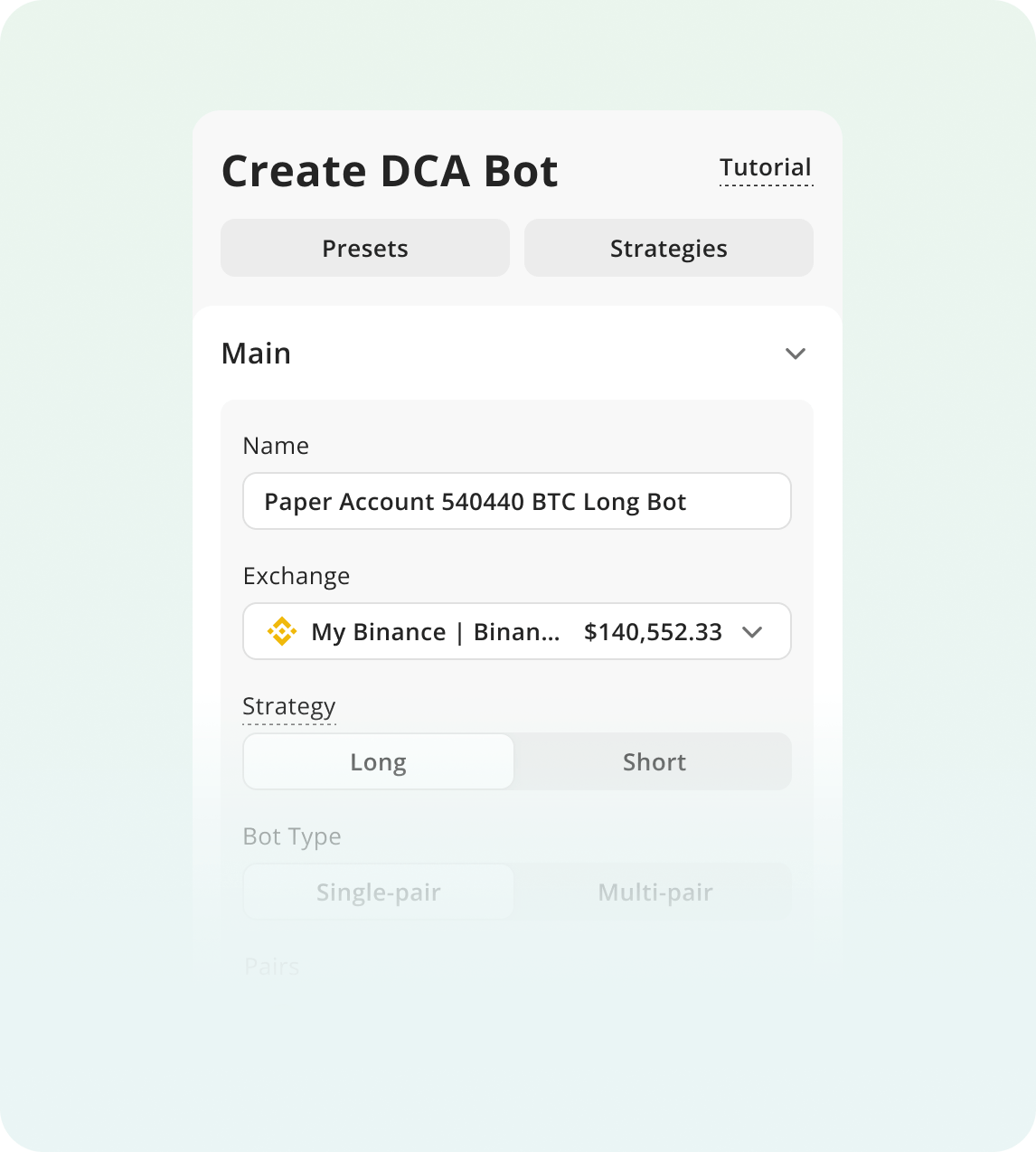

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

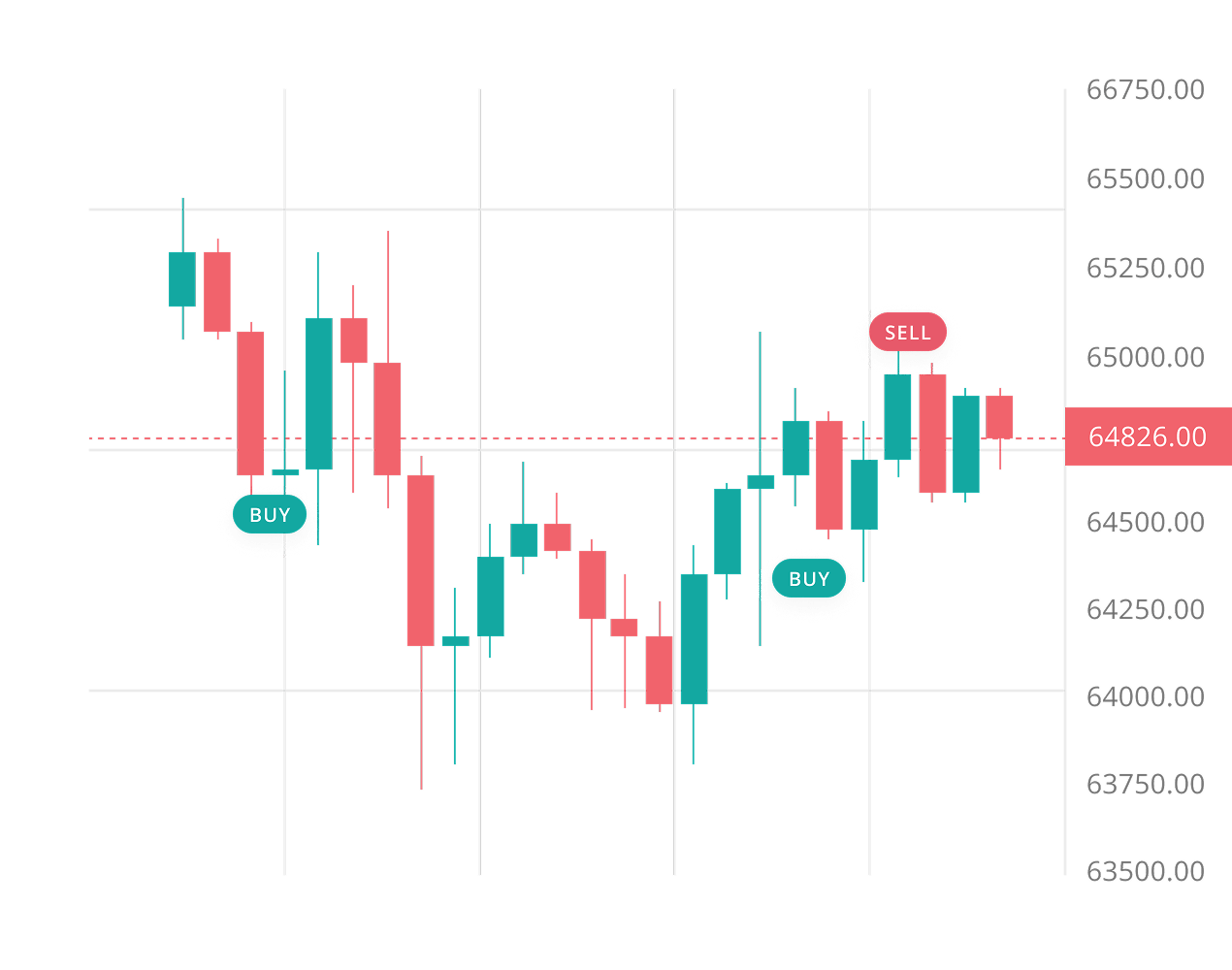

Manual trading meant emotional decisions. During BUSD's 2023 de-pegging, panic sellers lost up to 1.2% while automated traders stayed calm. Bots monitored markets 24/7, capturing 68% of significant moves that happened overnight when manual traders slept. Tools like Trailing Stop Loss limited losses to 0.3% versus 0.6% for manual traders during the August 2024 liquidity crunch. Automation removed emotion, never slept, and protected capital when it mattered most.

The stablecoin maintained a 1:1 peg to the US dollar, which provided price stability in volatile cryptocurrency markets.

BUSD was backed by cash reserves and US Treasury securities, with regular attestations from an independent accounting firm providing transparency about its reserves.

Integration with the Binance exchange meant zero trading fees on BUSD pairs for a time, and the asset was widely supported across centralized and decentralized platforms.

Set stop losses at 0.5% below entry for stablecoin positions. Even small de-pegs can signal bigger problems, so exit quickly if the $1.00 peg breaks.

Monitor regulatory announcements and reserve reports closely. Stablecoin stability depends on issuer compliance and backing transparency, not just market sentiment.

Spread holdings across multiple stablecoins like USDT, USDC, and DAI. Single issuer dependency exposes you to regulatory shutdowns and operational failures.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Binance USD strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your BUSD pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No. Bots automate your trading strategy, but they don't eliminate risk or guarantee returns. Market conditions, volatility, and your configuration all affect performance. BUSD had extremely low volatility during its operational period, so bots exploited small price movements and arbitrage opportunities. Profits depended on market conditions and settings. Bots require monitoring and adjustment. Automation makes execution faster and more consistent, but it doesn't create certainty in unpredictable markets.

Most users complete setup in 30-60 minutes. You'll connect your exchange account using API keys, then configure bot parameters like grid spacing and price ranges. The bot itself is straightforward, but exchange API setup can be confusing for beginners. 3Commas provides setup wizards, recommended settings, and documentation to guide you. You don't need coding skills. Start with small amounts, test your configuration, and monitor performance closely during your first week.

Yes. 3Commas is non-custodial, meaning we never hold your funds. The platform uses API keys to execute trades directly on your connected exchange account. We never request or use withdrawal permissions on API keys. Your crypto stays in your exchange account at all times. You control your funds. 3Commas only has permission to place trades based on your bot settings. If you're ever unsure, check your API settings to confirm withdrawal rights are disabled.

Yes. You can run multiple bots simultaneously, each executing different strategies or trading different pairs. This lets you diversify your approach without manually managing each position. For example, you could run one bot for stablecoin arbitrage and another for grid trading on different pairs. Each bot operates independently based on its own settings. This increases efficiency and lets you test different strategies side-by-side. Just ensure you have sufficient funds allocated to each bot.

Get trial with full access to all BUSD trading tools.