Meet the New 3Commas AI Assistant

Nov 24, 2025

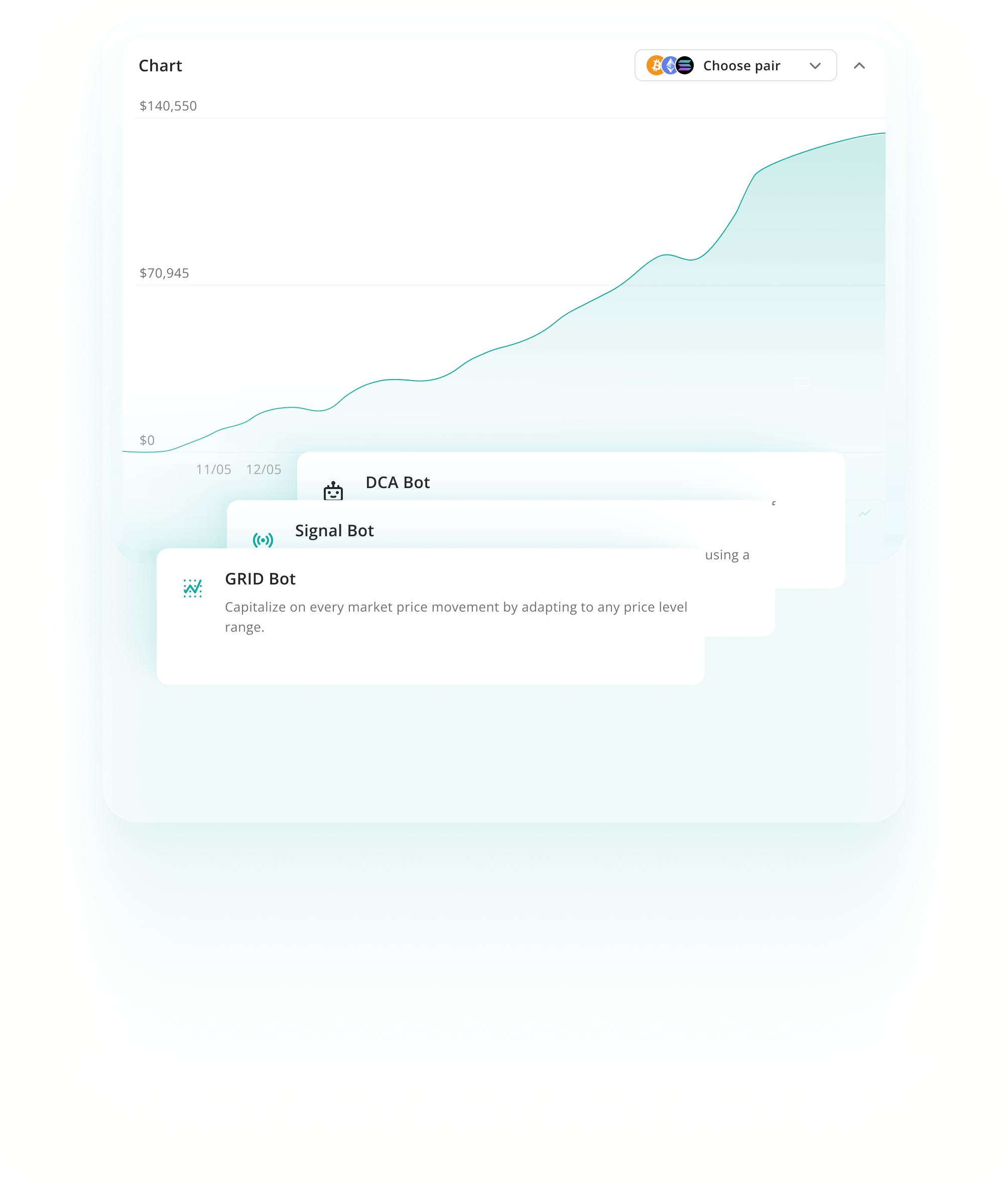

Automate your ETC trading strategies with 3Commas bots. Capture Ethereum Classic's frequent price swings using Grid, DCA, and Signal bots that execute trades 24/7. You connect via API only and maintain full control of your funds while our tools handle the monitoring and execution across major exchanges.

An Ethereum Classic trading bot is automated software that executes buy and sell orders for ETC on your behalf, following the strategy you set. It monitors ETC's price movements around the clock and places trades according to your predefined rules, which is especially useful given Ethereum Classic's frequent 3-10% daily swings.

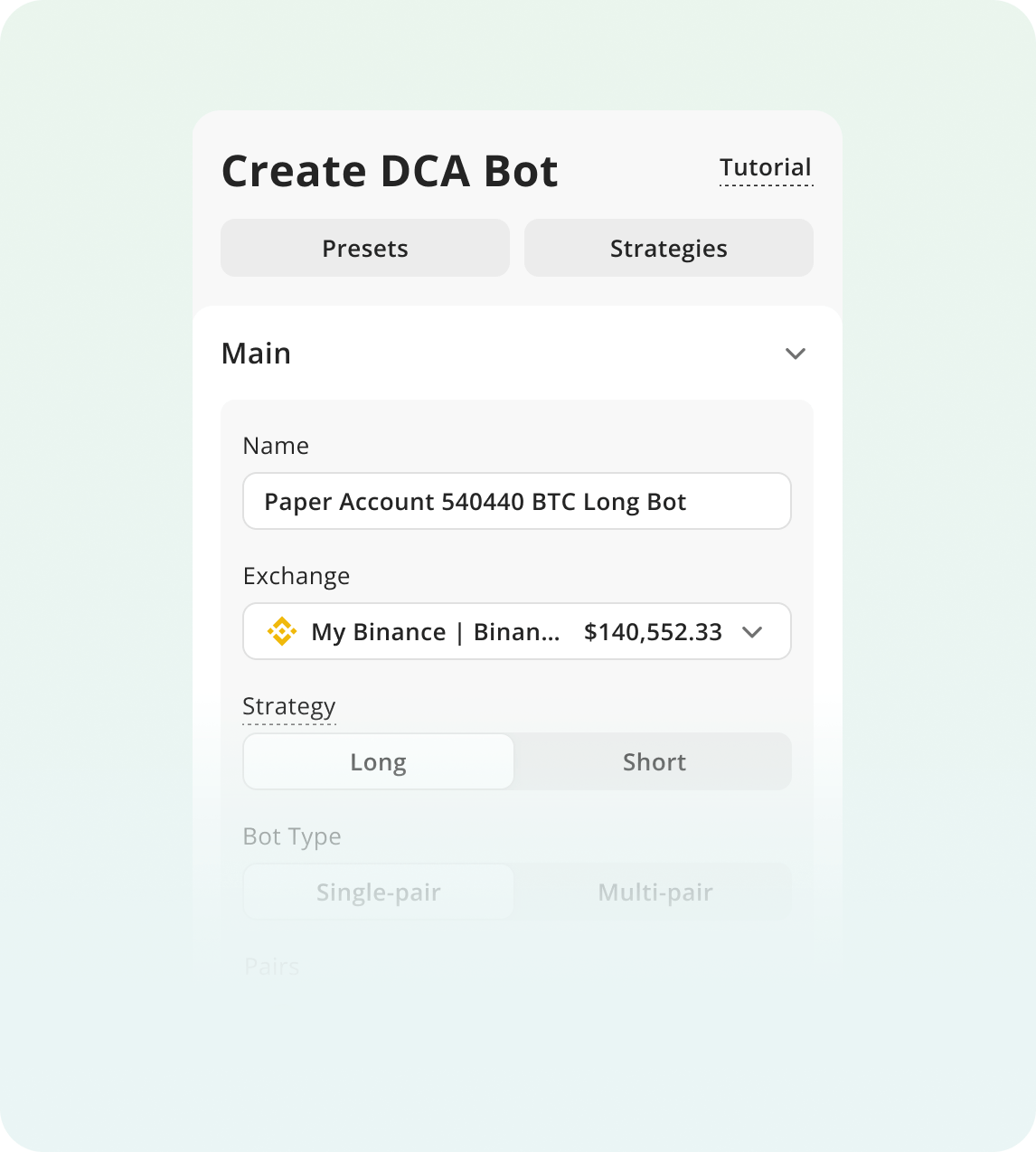

Dollar Cost Averaging bots split your investment into smaller purchases over time, reducing the impact of Ethereum Classic's 15-30% volatility swings. Instead of timing one entry, the bot buys at regular intervals. This approach lowers your average cost during ETC's pullbacks and corrections.

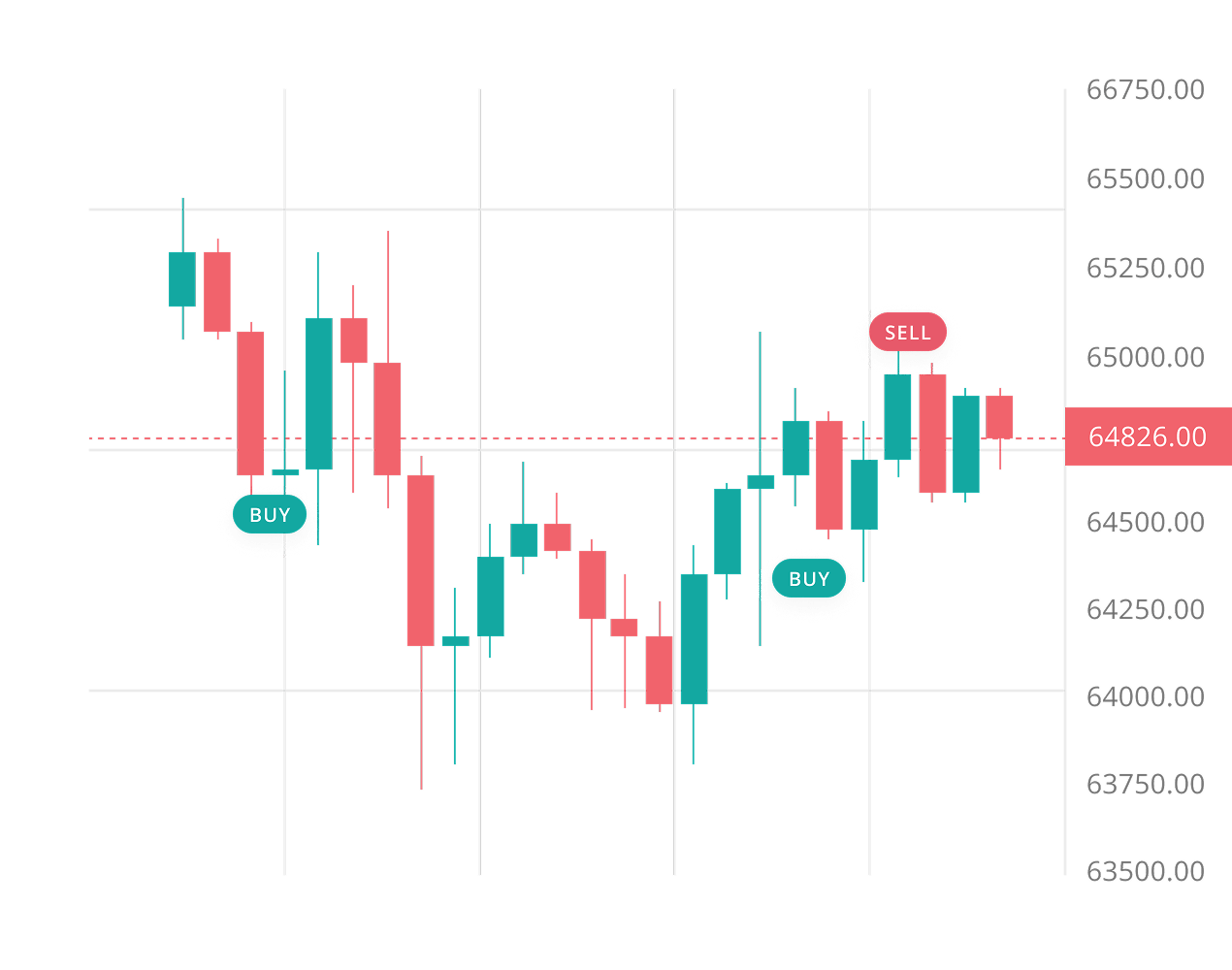

Learn moreGrid bots place multiple buy and sell orders at set price intervals, capturing profits from ETC's frequent 3-10% price swings. This strategy works best when Ethereum Classic trades sideways within a range. The bot automatically buys dips and sells peaks without constant monitoring.

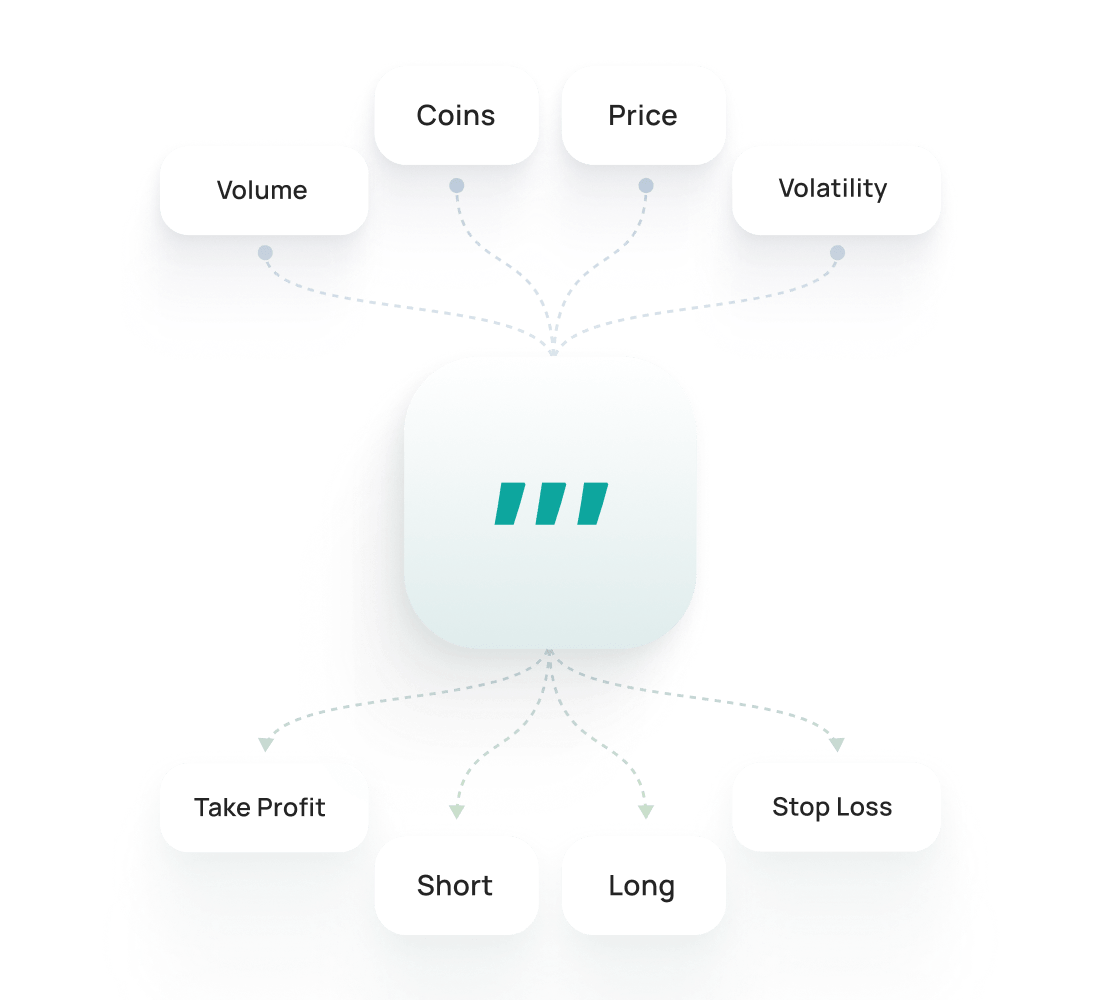

Learn moreSignal bots execute trades automatically when TradingView indicators like RSI, MACD, or moving averages trigger alerts. ETC responds predictably to these technical signals during breakouts and trending periods. The bot removes emotion from trading decisions and acts faster than manual execution.

Learn moreThe Ethereum Classic Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Ethereum Classic SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Ethereum Classic Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

Ethereum Classic's sharp price swings create real problems for manual traders. When ETC surges 15% in an hour, FOMO kicks in and people buy at the peak. When it drops 10% overnight, panic selling takes over. A trading bot removes these emotional reactions completely. It monitors ETC markets around the clock, catching the 20-30% overnight moves that happen while you sleep. The built-in Trailing Stop Loss and Take Profit tools protect you during ETC's sudden reversals, which can erase gains in minutes. You get consistent execution based on your strategy, not your feelings.

ETC offers superior liquidity with over $100M daily volume across all major exchanges, ensuring efficient order execution.

As the largest Proof of Work smart contract platform, Ethereum Classic provides unique exposure to PoW consensus investing.

Full EVM compatibility gives traders access to established infrastructure while maintaining the original Ethereum's immutable blockchain principles.

Set stop losses wider than usual, around 8 to 12 percent, to account for Ethereum Classic's frequent intraday volatility without getting stopped out prematurely.

Stay informed about network security updates and 51% attack discussions, as these events have historically triggered significant price drops for ETC.

Limit your Ethereum Classic position to a small percentage of your total portfolio, especially given the ongoing competition from newer smart contract platforms.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Ethereum Classic strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your ETC pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No bot guarantees profit. ETC's volatility creates opportunities, but markets are unpredictable. Bots automate your strategy and remove emotions from trading, but they can't predict price movements. You need to monitor performance, adjust settings, and understand that losses happen. Think of bots as tools that execute faster and more consistently than manual trading, not as money-printing machines. Your strategy and market conditions determine results.

Setup takes about 10 minutes and requires no coding skills. You connect your exchange via API keys, choose a bot type like DCA or Grid, set your budget and parameters, then activate. 3Commas provides preset templates for ETC that work out of the box. The interface walks you through each step with clear explanations. If you can use a smartphone app, you can set up a trading bot.

Yes. 3Commas never holds your funds. Your Ethereum Classic stays on your exchange account. We only use API keys with trading permissions, never withdrawal rights. This means bots can execute trades but cannot move your ETC or other assets off the exchange. You maintain complete control. Even if our platform were compromised, nobody could withdraw your crypto. Your exchange account security remains your responsibility.

Absolutely. You can run several bots simultaneously with different strategies on the same exchange account. For example, one Grid bot capturing ETC's short-term swings, one DCA bot building a long-term position, and another trading different pairs entirely. Each bot operates independently with its own allocated funds. This lets you diversify approaches and test what works best for your goals without managing everything manually.

Get trial with full access to all ETC trading tools.