Meet the New 3Commas AI Assistant

Nov 24, 2025

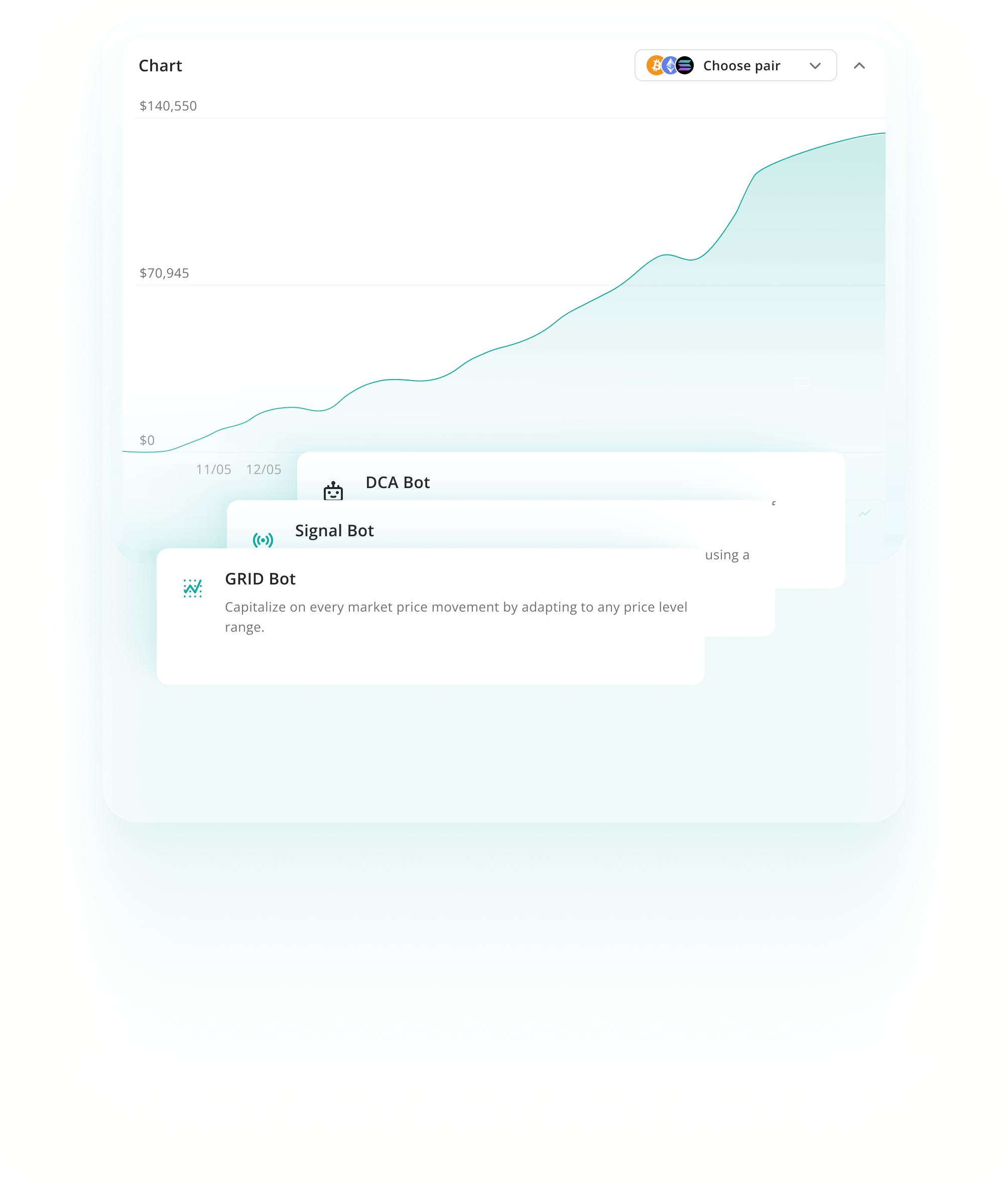

Automate your CRO trading strategies 24/7 without emotional decisions. Take advantage of Cronos' daily price swings and ranging patterns with smart bots that execute Grid, DCA, and Signal strategies while you focus on the bigger picture. Trade systematically across the growing Crypto.com ecosystem with tools built for volatility.

A Cronos trading bot is software that automatically buys and sells CRO cryptocurrency for you. It connects to your exchange through API keys and executes trades based on strategies you set up. The bot works around the clock, reacting to Cronos price changes without emotions or hesitation. Your funds never leave your exchange because 3Commas uses API connections without withdrawal permissions. This makes automated trading more systematic than doing it manually.

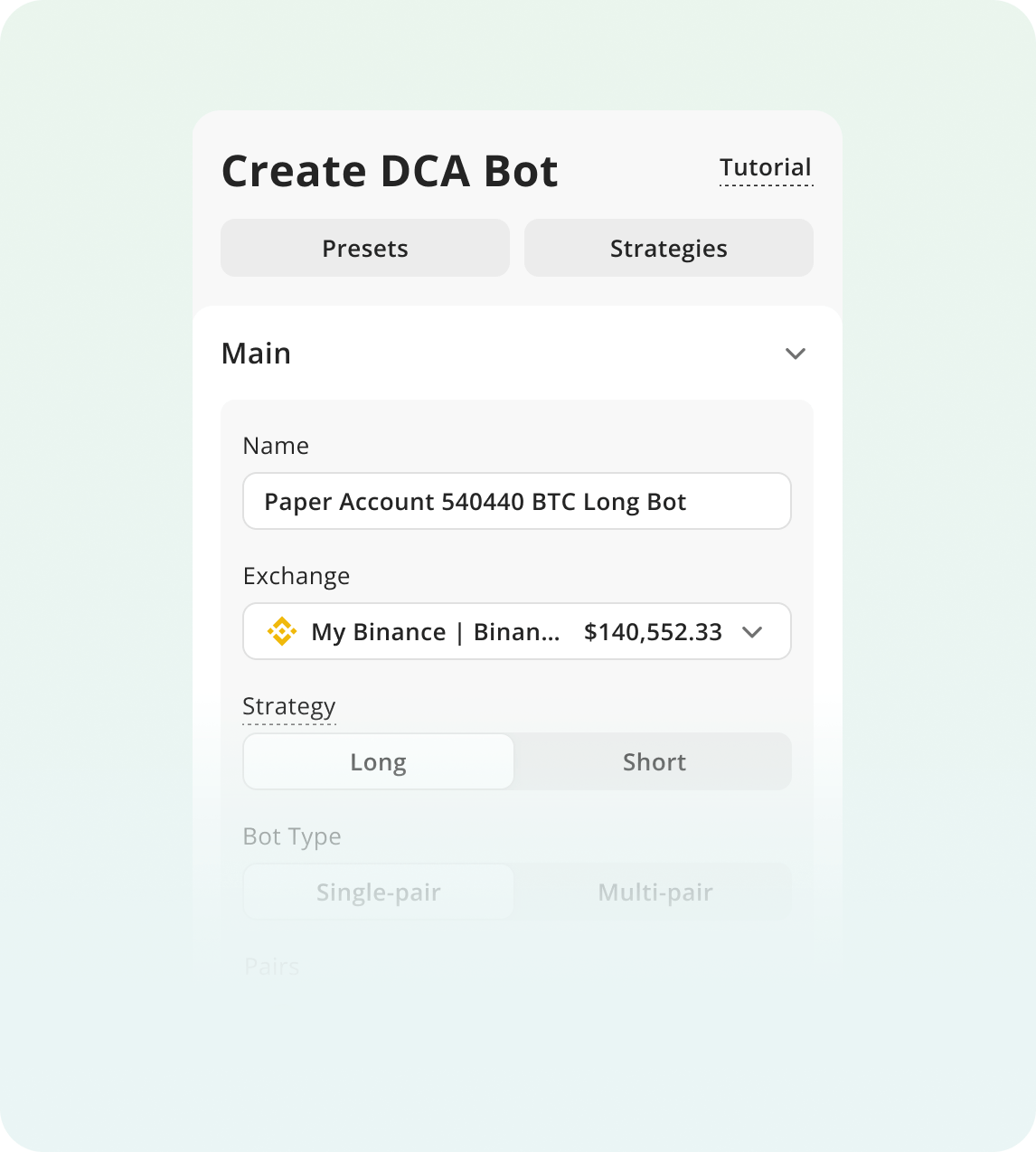

Dollar Cost Averaging spreads your CRO purchases over time instead of buying all at once. This approach smooths out the impact of Cronos' 3 to 7% daily swings and sudden 10 to 20% corrections. You build your position gradually, reducing the risk of buying at a peak price.

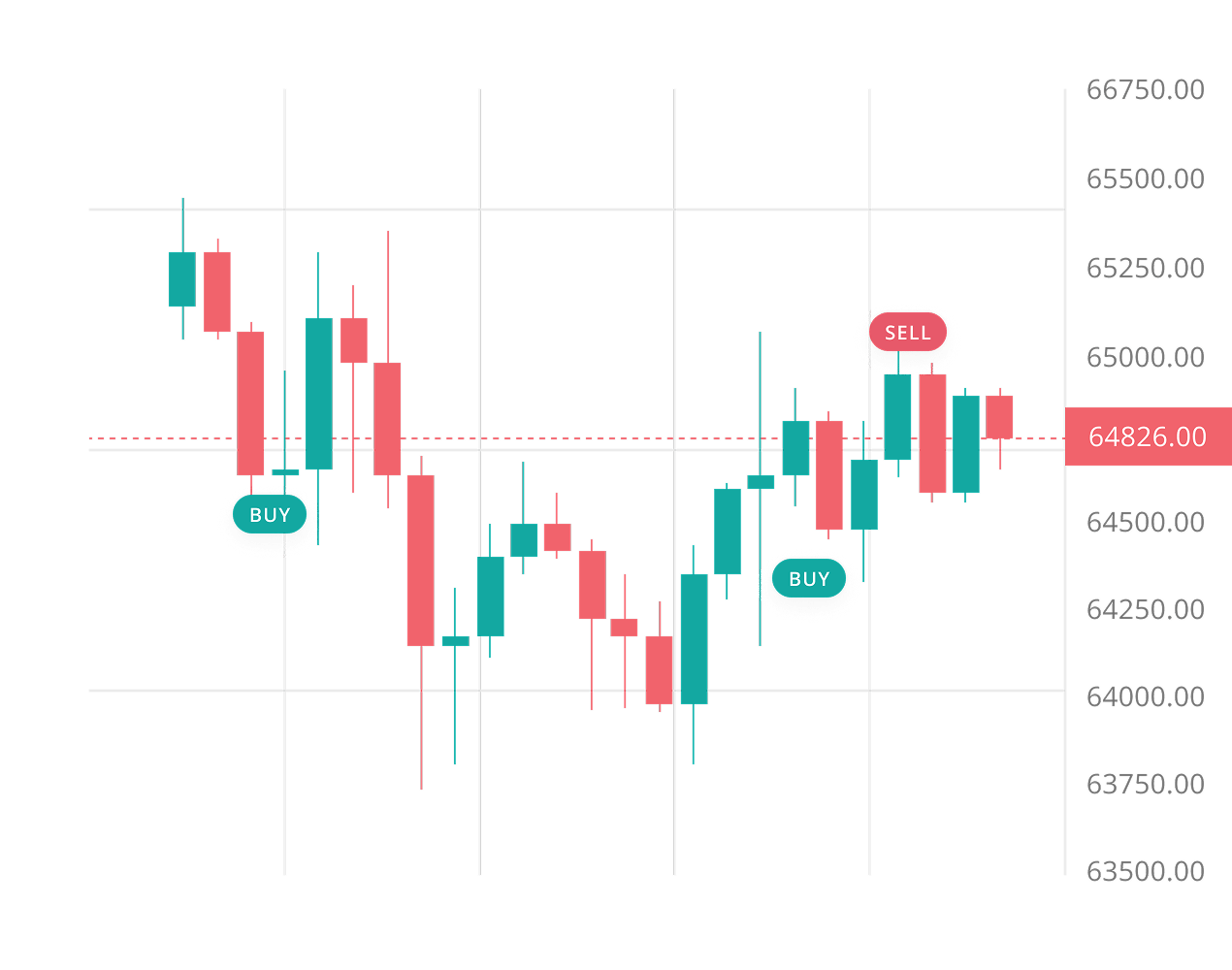

Learn moreGrid bots place multiple buy and sell orders across set price ranges. They profit from Cronos' frequent sideways movements, which occur 30 to 50% of the time within 10 to 25% channels. Each small price swing generates trading opportunities. The bot buys low and sells high automatically without your constant attention.

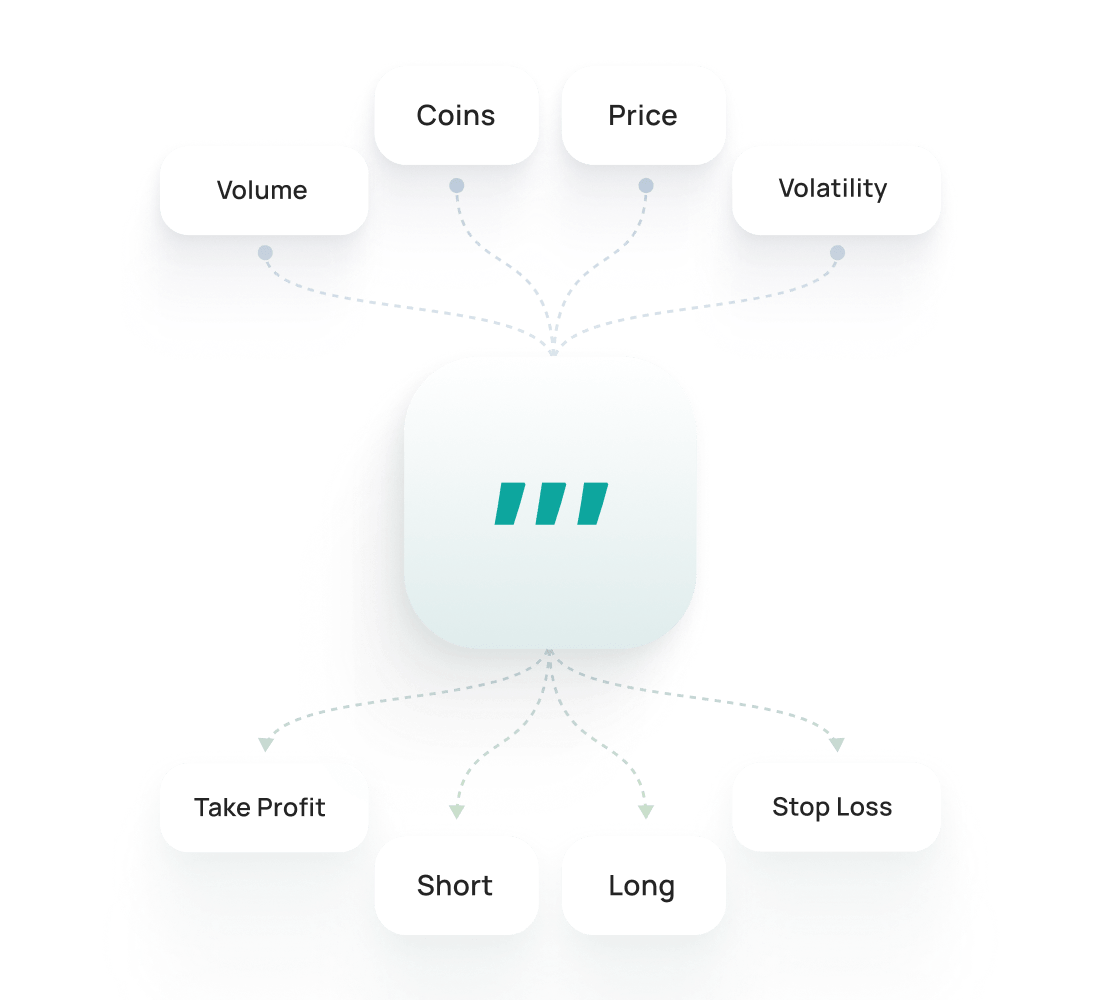

Learn moreSignal bots execute trades based on technical indicators from TradingView and other platforms. They respond to momentum signals like RSI, MACD, and moving averages. This strategy works well during CRO's trending periods when clear directional movement emerges. The bot follows your chosen indicators without emotional interference.

Learn moreThe Cronos Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Cronos SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Cronos Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

Trading CRO manually is exhausting. You're fighting your emotions during news spikes, missing overnight moves while you sleep, and watching profits vanish during sudden reversals. A Cronos bot removes these problems. It trades without fear or greed, monitors markets 24/7, and protects your positions with trailing stop losses that move with the price. When CRO swings 15% at 3 AM, your bot is working. When panic hits the market, it sticks to the plan. Simple as that.

Direct exposure to Crypto.com's expanding ecosystem, including DeFi wallet integration, NFT marketplace activity, and payment solutions growth.

Predictable transaction costs through Proof of Authority consensus make automated trading strategies more reliable and easier to calculate.

Cross-chain interoperability via IBC protocol opens trading opportunities across multiple blockchain networks without leaving the Cronos ecosystem.

Set stop losses at 5-8% below your entry point to account for CRO's normal daily swings of 3-7%. Wider stops help avoid getting shaken out by regular volatility while still protecting your capital from major downturns.

Monitor Crypto.com announcements closely since CRO's price heavily depends on the exchange's performance and reputation. Watch for regulatory news, partnership deals, security incidents, and major platform updates that can trigger sudden price movements.

Keep your CRO position size reasonable as part of a diversified portfolio. Consider the centralization risks from its limited validator set and the token's tight connection to a single company's success when deciding how much to allocate.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Cronos strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your CRO pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No trading bot can guarantee profits. CRO's moderate to high volatility creates opportunities, but losses are always possible. Bots excel at automation and disciplined execution—removing emotion from trading decisions. They work 24/7 to capture price movements you'd miss manually. Grid bots perform well during CRO's frequent ranging periods, while DCA bots help accumulate during downtrends. Success depends on market conditions, strategy selection, and proper configuration. Think of bots as tools that improve efficiency, not magic money machines.

Setting up a CRO bot on 3Commas is surprisingly simple, even for beginners. Connect your exchange via API keys (takes 5-10 minutes), select CRO as your trading pair, and choose a strategy template. No coding required. The platform offers pre-configured bots optimized for different market conditions. Start with small amounts to learn how your chosen strategy performs. Most users complete their first bot setup in under 20 minutes. The interface guides you through each step with clear explanations and recommended settings.

Yes. 3Commas operates as a non-custodial platform, meaning your CRO always remains on your exchange—never transferred to 3Commas. The platform only uses API keys with trading permissions, specifically configured WITHOUT withdrawal rights. This means 3Commas can execute buy and sell orders on your behalf but cannot move funds off your exchange account. You maintain complete control over your assets. Always verify withdrawal permissions are disabled when creating API keys. Your crypto stays exactly where you deposited it.

Absolutely. You can operate several bots with different strategies on the same exchange account. Run a grid bot to profit from CRO's sideways movements while simultaneously running a DCA bot for long-term accumulation. Each bot functions independently with its own allocated funds. This diversification helps balance risk across varying market conditions—when trends emerge, your signal bot activates; during consolidation, your grid bot works. Just ensure you have sufficient balance allocated to each bot to avoid order failures.

Get trial with full access to all CRO trading tools.