Meet the New 3Commas AI Assistant

Nov 24, 2025

Automate your KAS trading strategy to capture Kaspa's daily volatility without constant monitoring. Remove emotion from your decisions and execute disciplined trades 24/7 across multiple exchanges. Let automation handle the timing while you stay in control of your capital and risk parameters.

A Kaspa trading bot automates your trades based on rules you set. It buys, sells, and sets stop-losses without emotion or sleep. For KAS's high volatility and 24/7 market, bots capture opportunities you'd miss manually. Your funds stay on your exchange. 3Commas uses API keys with trading access only, withdrawal rights blocked by design. It can't touch your money.

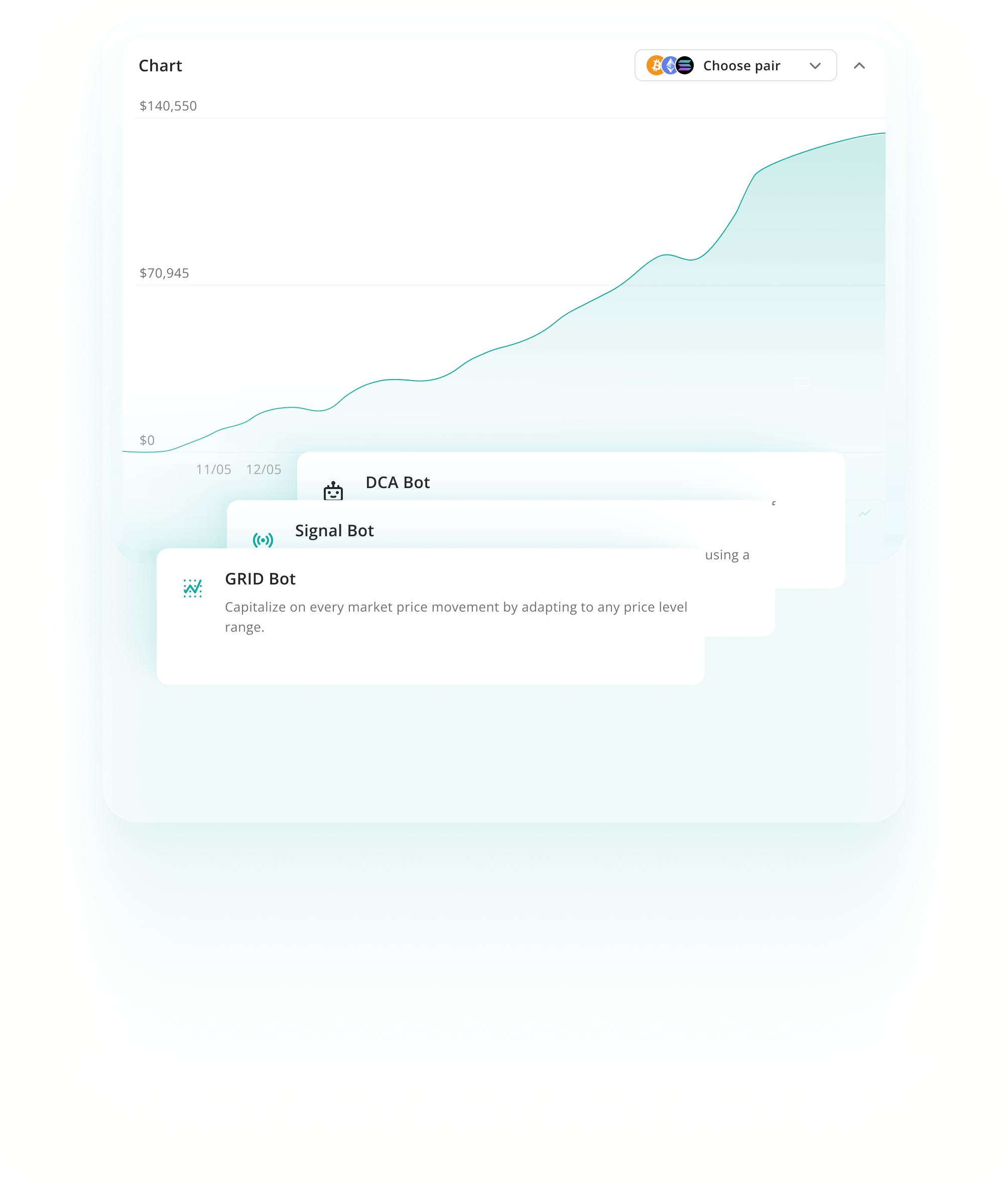

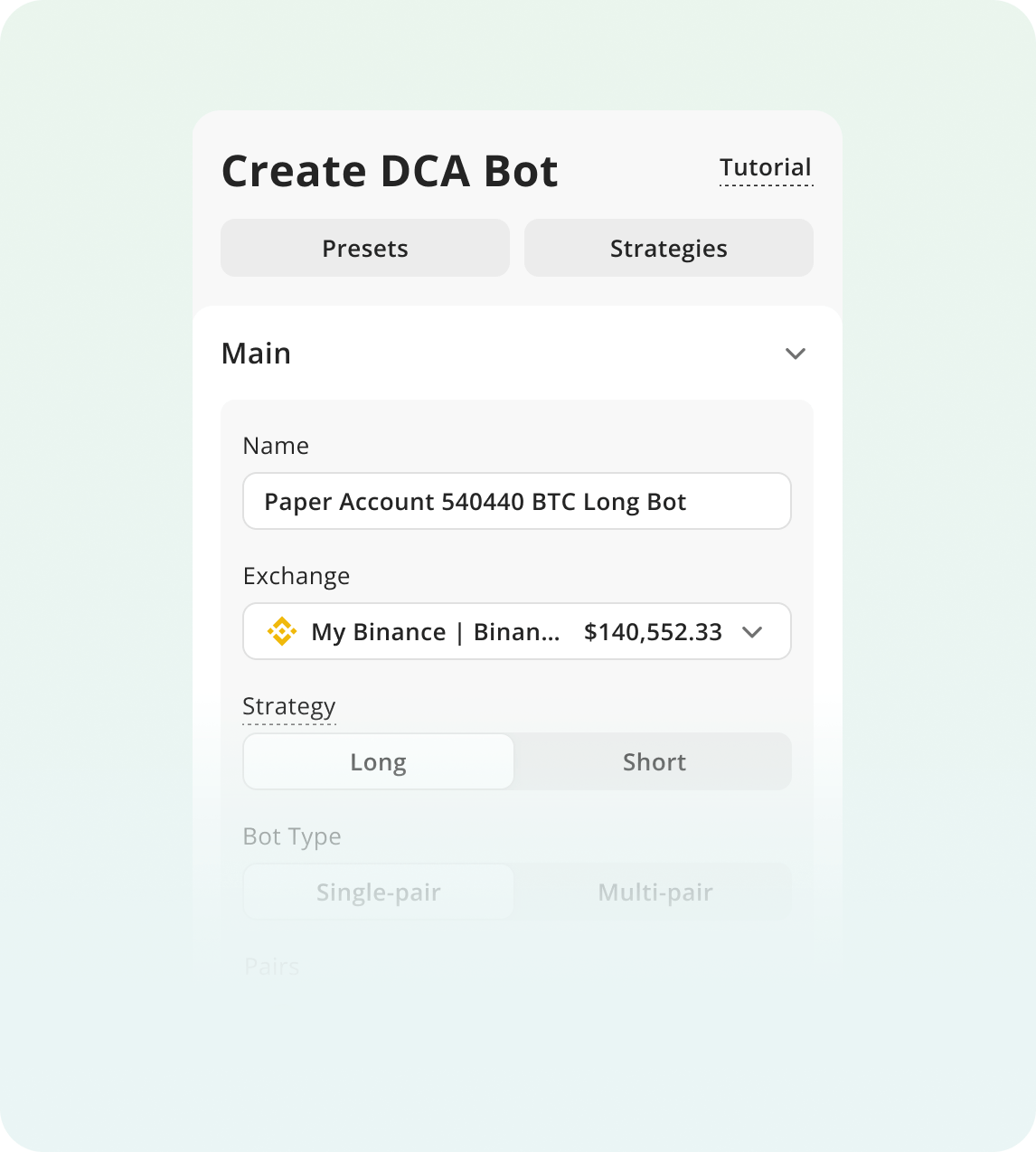

Dollar-cost averaging spreads your KAS purchases over time instead of buying all at once. This reduces the risk of entering at a bad price during Kaspa's frequent 25-35% flash crashes. Most effective for managing timing risk in volatile assets like KAS.

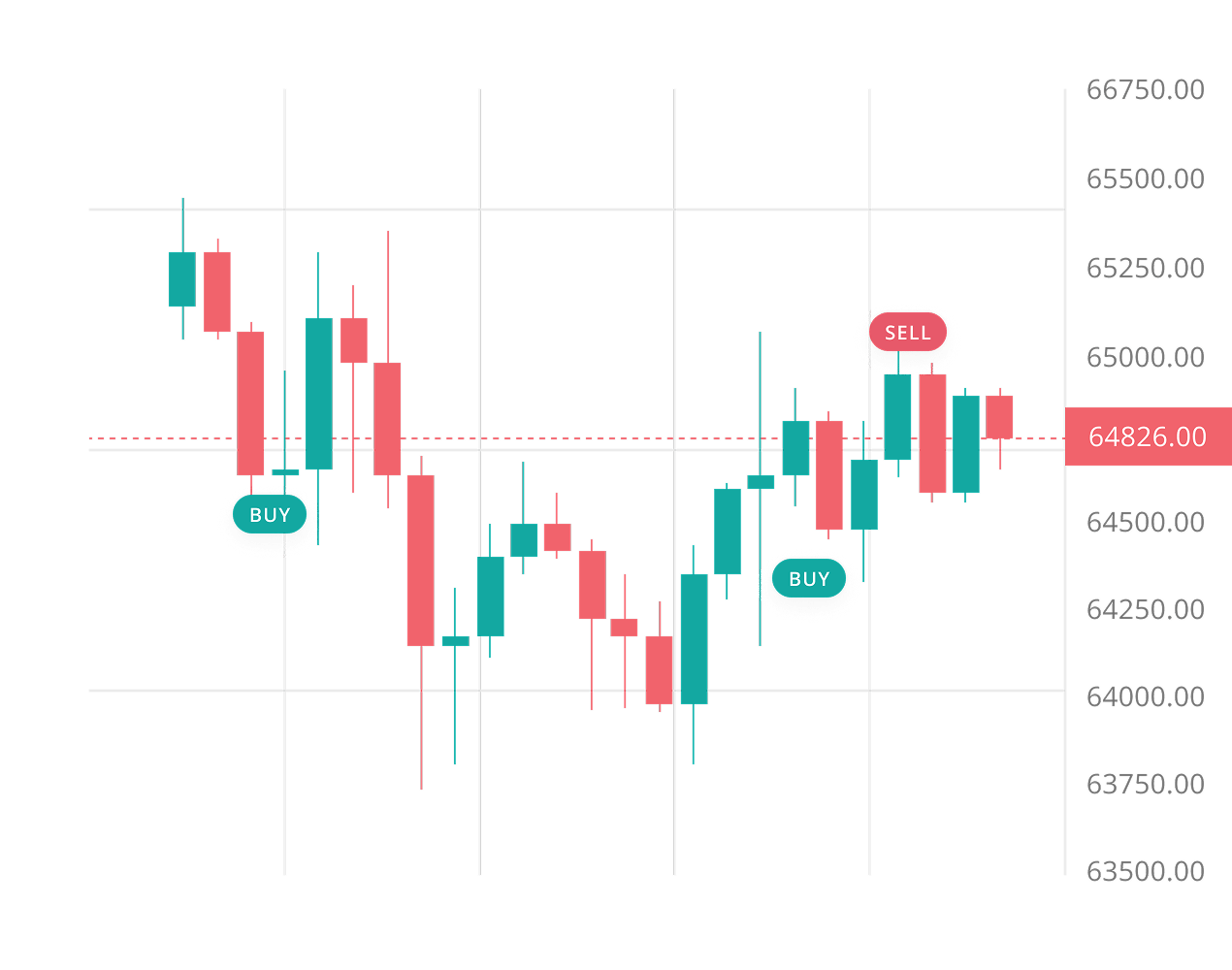

Learn moreGrid bots place multiple buy and sell orders at set intervals within a price range. They capture profits from KAS volatility without needing to predict direction. This works best during Kaspa's consolidation phases when price bounces between support and resistance levels repeatedly.

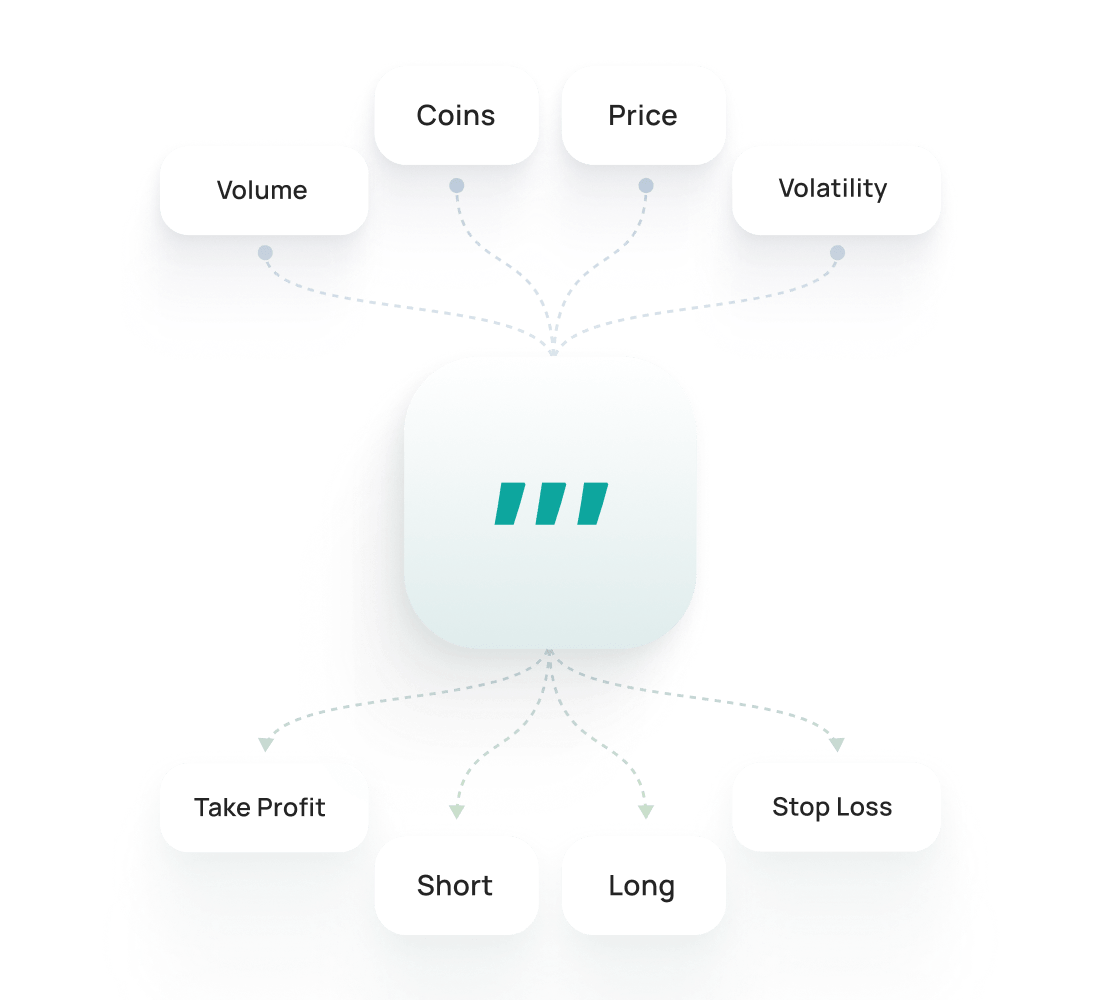

Learn moreSignal bots execute trades automatically based on technical indicators from TradingView. They remove emotional decisions and follow proven setups like RSI reversals or MACD crosses. Best suited for traders who already use technical analysis to trade Kaspa but want automated execution.

Learn moreThe Kaspa Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Kaspa SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Kaspa Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

Kaspa's 8-15% daily swings create real problems for manual traders. You're either glued to charts or waking up to overnight losses you couldn't prevent. The bot eliminates panic decisions during sharp moves and monitors KAS 24/7 while you sleep or work. Trailing stops lock in gains automatically when price reverses, and take profit orders execute without hesitation. It's not about chasing returns, it's about protecting your capital with disciplined, emotion-free execution that manual trading can't match.

Listed on Coinbase and Kraken with over $100M daily volume, providing institutional access and deep liquidity.

KAS features 1-second block times with sub-penny fees, allowing fast bot execution without eating into profits.

Daily volatility of 8-15% creates frequent price swings that automated grid strategies can capture consistently.

Set stop-losses at least 10% below your entry price. KAS regularly swings 8-15% daily, and tighter stops will get triggered by normal volatility.

Watch for exchange listing announcements and mining pressure events. Kaspa isn't on Coinbase or Kraken yet, and the 12% monthly emission decrease creates ongoing sell pressure.

Never risk more than you can afford to lose. KAS is a mid-cap asset ranked around #80 with higher volatility than Bitcoin or Ethereum.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active Trading Accounts

5

Active DCA Bots

0

Active Signal Bots

2

Active Grid Bots

10

Active SmartTrades

20

Active DCA Trades

0

Active Signal Trades

10

DCA Backtests

1 year period

10

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active Trading Accounts

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

50

Active SmartTrades

100

Active DCA Trades

100

Active Signal Trades

50

DCA Backtests

2 years period

50

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$200/ month

AI Assistant

Spot & Futures

15

Active Trading Accounts

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active SmartTrades

5K

Active DCA Trades

5K

Active Signal Trades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Kaspa strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your KAS pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No bot can guarantee profits in crypto markets. KAS experiences 8-15% daily price swings, creating opportunities but also risk. Bots automate your chosen strategy and execute trades 24/7 without emotion. They follow your rules consistently, but market conditions constantly change. All crypto trading involves risk of loss. Bots provide automation and efficiency, not profit guarantees. Your results depend on market conditions, strategy selection, and risk management settings.

You don't need coding skills to start. 3Commas offers pre-built templates for DCA and Grid strategies that work well with Kaspa's volatility. Your first setup typically takes 1-2 hours following tutorials. After that, launching new bots takes 10-15 minutes. The platform uses a visual interface where you select settings from dropdown menus. If you can use a smartphone app, you can configure a basic bot. Start simple and expand as you learn.

3Commas operates on a non-custodial model. Your funds never leave your exchange account. API keys only grant trade-only access without withdrawal permissions. You configure these restrictions when creating keys on your exchange. 3Commas can execute buy and sell orders but cannot withdraw or transfer your KAS or other assets. Never enable withdrawal permissions on API keys. Your cryptocurrency remains on the exchange under your control at all times.

Yes, you can operate multiple bots simultaneously with different strategies. Many traders run both Grid bots during KAS consolidation periods and DCA bots during trending markets. Each bot works independently with its own capital allocation. Kaspa's 1-second block times and consistent volatility patterns make it suitable for automated Grid trading. You can test different approaches, adjust parameters separately, and diversify your automated trading methods across market conditions.

Get trial with full access to all KAS trading tools.