Meet the New 3Commas AI Assistant

Nov 24, 2025

Upgrade your Sandbox plan with a 3Commas SAND trading bot that automates entries, exits, and scaling. Use DCA to build into momentum across DeFi catalysts, plus other 3Commas tools. Connect via secure API, monitor 24/7, and enforce clear risk rules for consistency.

A 3Commas Sandbox bot automates SAND execution via secure API keys and 24/7 monitoring, so you respond to DeFi-driven moves instantly. Configure rules once, then let the system place entries, exits, and safety steps. Use DCA for trend legs or SmartTrade for precise TP/SL and trailing, removing emotion while keeping risk parameters consistent.

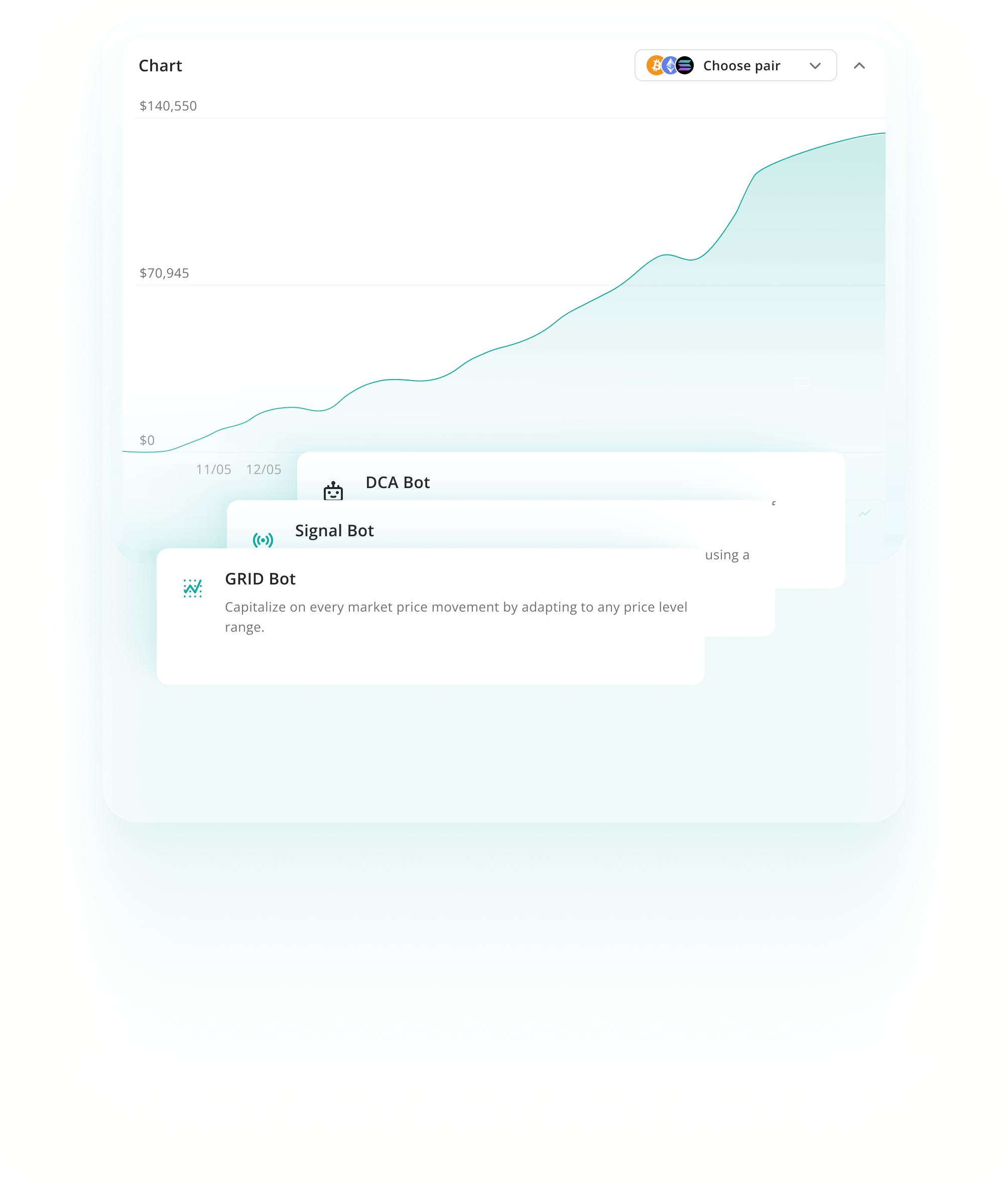

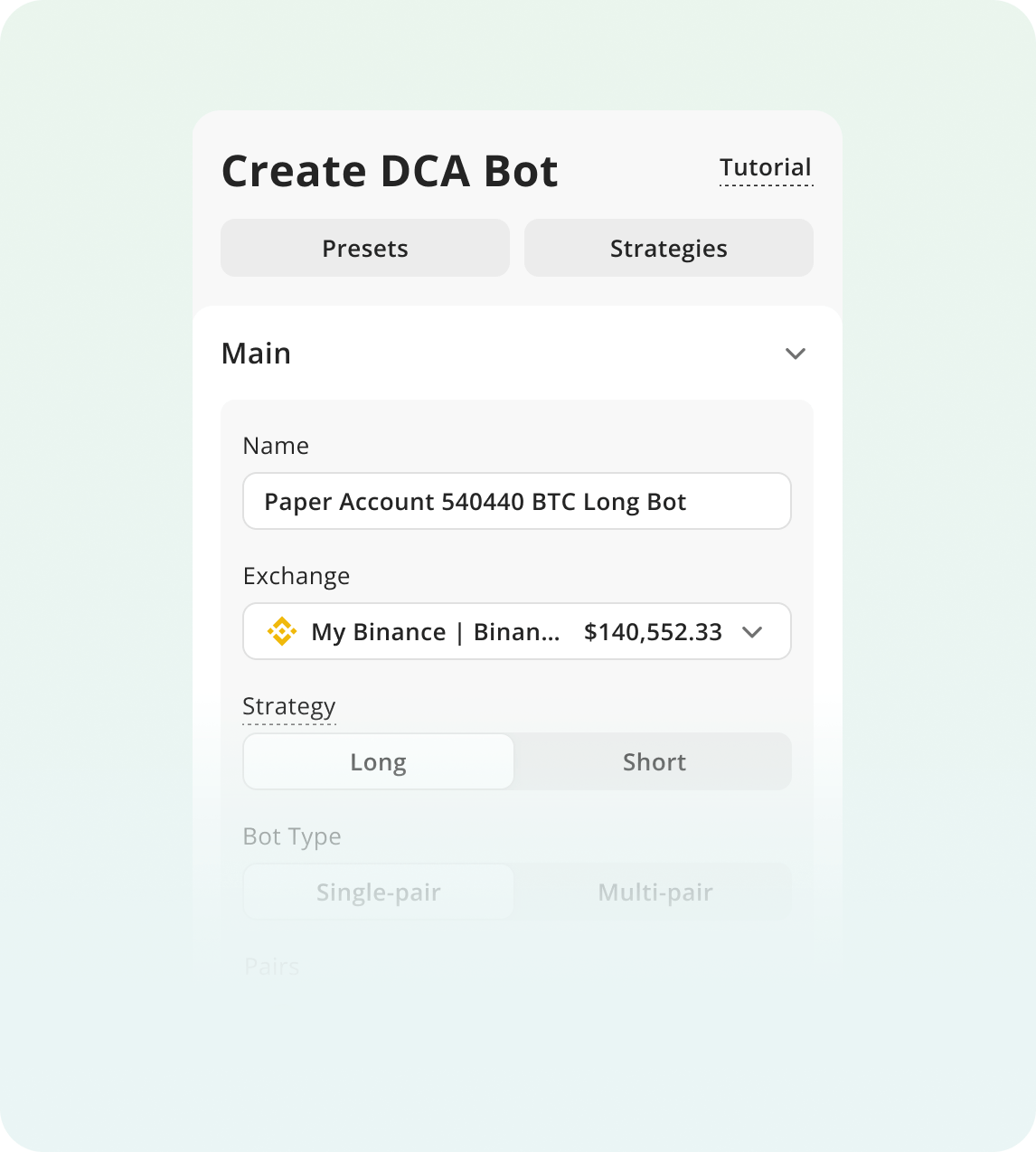

The Sandbox DCA bot adds positions as the price dips (for longs) or rises (for shorts), adjusting your take-profit each time. It’s perfect for volatile assets like Sandbox – you can accumulate more Sandbox at better prices during dips, or systematically exit a position during rallies. This strategy reduces the impact of timing the market by averaging your entry price.

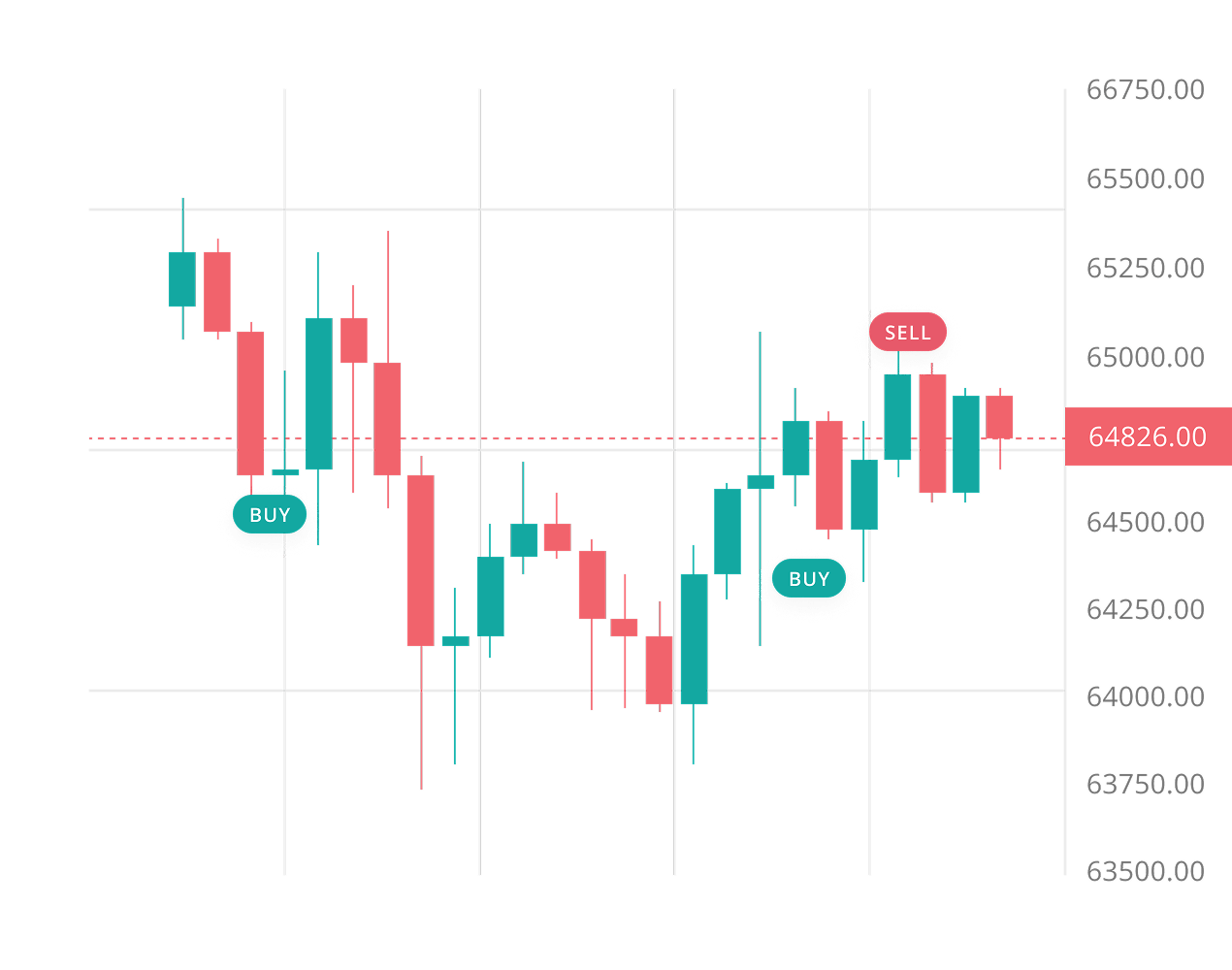

Learn moreThe Sandbox Grid strategy creates multiple buy and sell orders within a defined price range, profiting from SAND price fluctuations. This strategy works exceptionally well in sideways markets, generating consistent profits from Sandbox 's natural volatility.

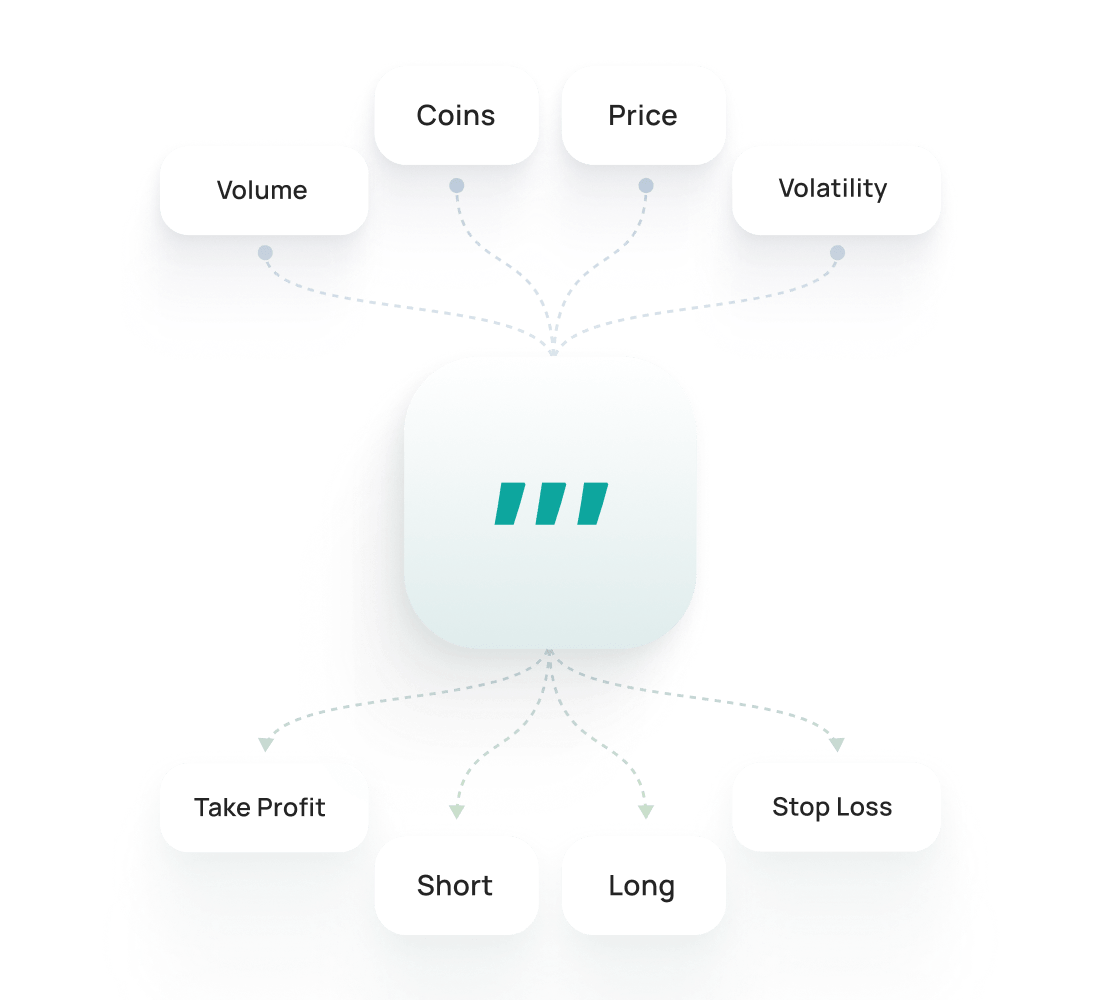

Learn moreThe Sandbox Signal Bot executes trades based on TradingView indicators and custom signals, allowing automated SAND trading with advanced technical analysis. Connect your favorite strategies via webhooks and let the bot handle precise entry and exit points for maximum trading efficiency.

Learn moreThe Sandbox Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Sandbox SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Sandbox Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

The 3Commas Sandbox bot keeps SAND trading disciplined when DeFi catalysts and gas spikes create whipsaws. Configure rule-based entries, exits, and protections, then let automation watch markets 24/7. Grid, DCA, and signals translate volatility into structured execution, while SmartTrade tools help enforce risk and take profit logic without emotional decisions.

Sign Up or Log In if you have an account

Connect an exchange via API (e.g. Binance, KuCoin, etc.) where you hold Sandbox

Create your Sandbox bot by choosing a strategy (Grid, DCA, etc.) and selecting your Sandbox trading pair.

Start the bot and let it run 24/7. You can monitor its progress and adjust settings or stop it at any time.

Sandbox demonstrates thinner books with episodic bursts volatility patterns, making it suitable for automated trading strategies. With a market cap of $1–5B and daily trading volume of $100–500M, SAND offers excellent liquidity for bot trading. Historical data shows Sandbox responds well to DCA and Signal strategies, particularly during scale-in on dips; indicator cues for timing market conditions.

Game and partnership launches create bursts of attention; rules help capture moves without chasing hype.

Creator activity supports volume, making range trading and partial profit-taking easier to execute consistently.

After spikes, Sandbox often settles into tradable corridors that suit grid rebuilding and scheduled exits.

Trading Sandbox requires careful risk management due to its high volatility. Our SAND trading bot includes built-in risk management features like position sizing, stop-loss orders, and portfolio diversification. Always consider bridge/tooling maturity, listing churn, validator/governance issues when trading Sandbox and never invest more than you can afford to lose.

Set appropriate stop-loss levels for SAND volatility

Never invest more than 8–15%% in Sandbox trading

Monitor gas fee spikes, L2/bridge incidents, major upgrade timing that affect Sandbox price

AI Assistant

1

Active Trading Accounts

5

Active DCA Bots

0

Active Signal Bots

2

Active Grid Bots

10

Active SmartTrades

20

Active DCA Trades

0

Active Signal Trades

10

DCA Backtests

1 month period

10

GRID Backtests

4 months period

Developers API

Read only

TradingView integration

Futures

Spot

Live Chat Support

AI Assistant

3

Active Trading Accounts

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

50

Active SmartTrades

100

Active DCA Trades

100

Active Signal Trades

50

DCA Backtests

6 months period

50

GRID Backtests

4 months period

Developers API

Read only

TradingView integration

Futures

Spot

Live Chat Support

AI Assistant

15

Active Trading Accounts

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active SmartTrades

5K

Active DCA Trades

5K

Active Signal Trades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

TradingView integration

Futures

Spot

Priority Live Chat Support

Run your Sandbox strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your SAND pairs.

Secure by Design. Reliable. Transparent.

We proactively fortify our security measures to meet evolving threats.

Our software is compliant with stringent regulations so you can put your mind at ease.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

Apply structure: fixed caps, stop-losses, and gradual scaling. 3Commas uses restricted API keys; funds remain on the exchange. For Sandbox, watch bridge and tooling maturity, validator or governance updates, and listing churn. Start with demo trading, then small capital once execution looks steady across sessions.

There is a free plan to begin and paid tiers with more bots and features. See the pricing block on this page or the pricing page on our website for current details.

Fast finality and low fees support dense grids in steady ranges, while Signals or DCA can join momentum around upgrades or integrations. Keep step sizes modest and targets realistic. Backtest spacing and exits, then confirm in demo mode during both calm and busy hours.

Bridge incidents, validator changes, and early-ecosystem shifts can alter volatility and spreads. Reduce size near known dates, keep stops active, and pause if behavior turns irregular. Resume only after fills stabilize.

Useful for idea screening, not a guarantee. Confirm with demo trades before scaling.

Get trial with full access to all SAND trading tools.