Meet the New 3Commas AI Assistant

Nov 24, 2025

UNI moves fast with daily volatility and frequent price swings that create constant opportunities. Manual trading means missing profitable moments in this DeFi blue-chip token. Automate your strategy to capture UNI's ranging patterns 24/7 while you sleep. Your funds stay in your exchange account. We only execute trades through secure API connections.

A Uniswap trading bot automatically buys and sells UNI tokens based on rules you set. It works around the clock, executing your strategy without emotions getting in the way. Since UNI experiences frequent price swings, automation helps you react faster and more consistently than manual trading. With 3Commas, your funds stay secure because we never hold your assets. Our API connection only allows trading, not withdrawals, so you maintain complete control.

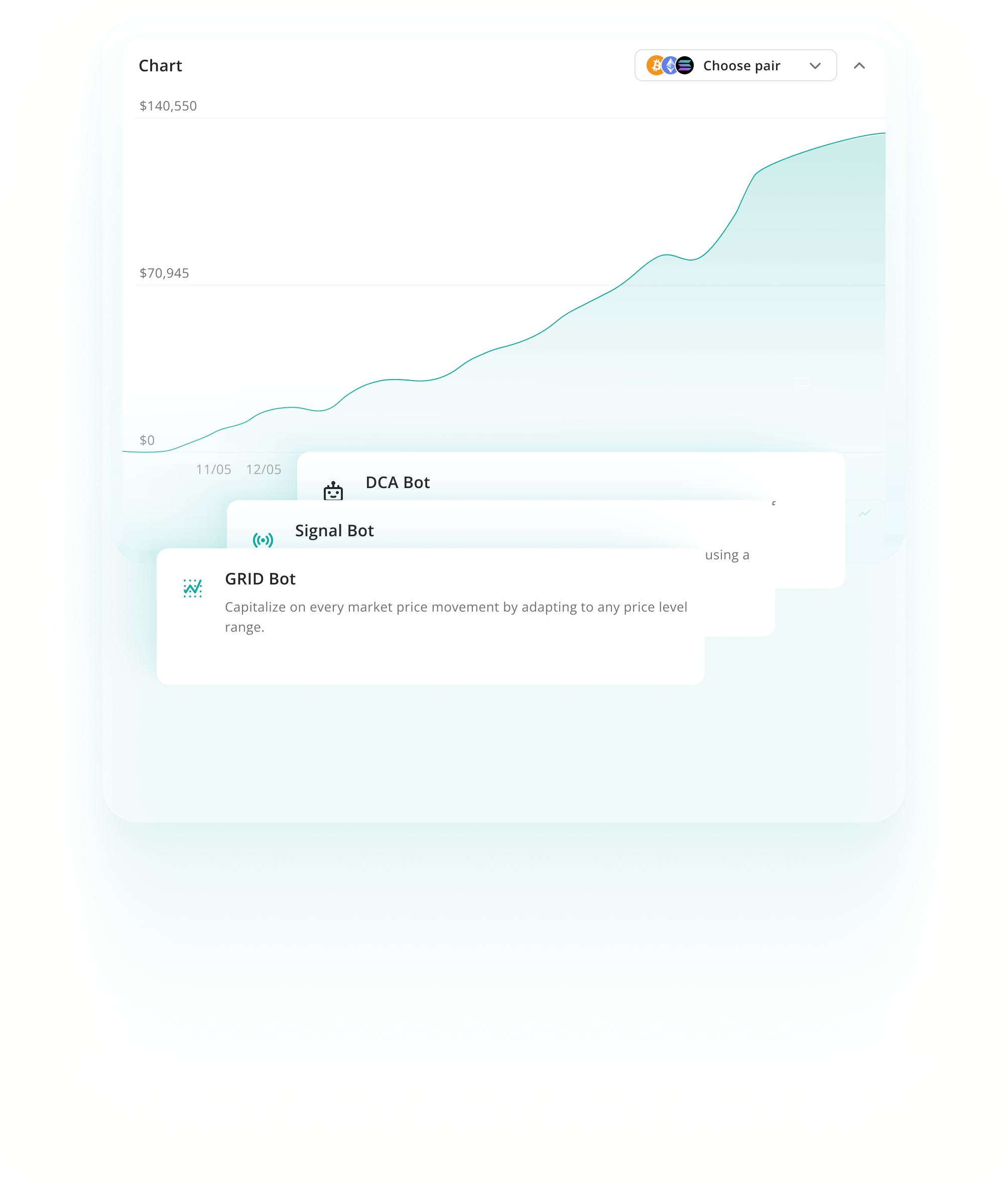

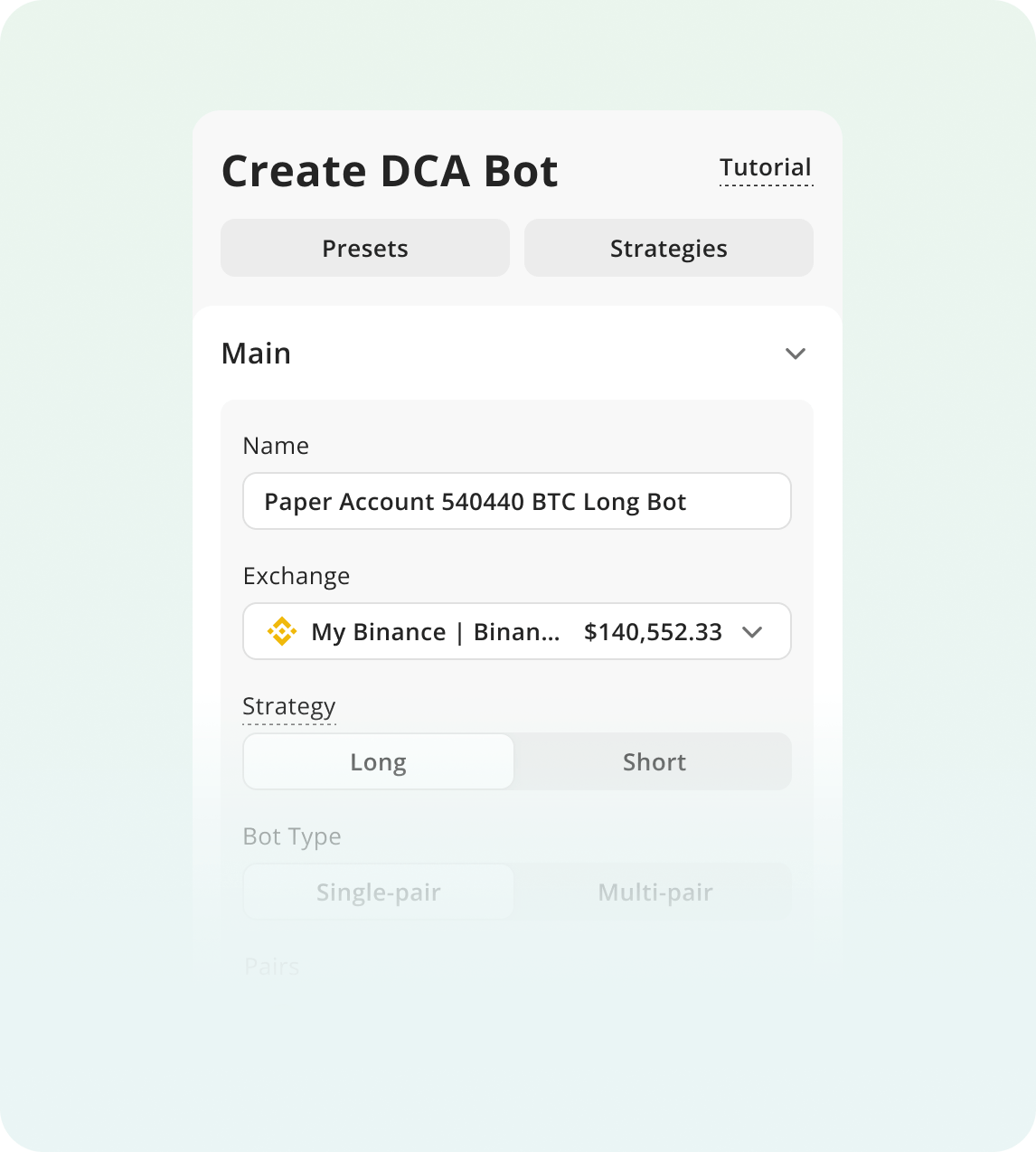

DCA bots spread your Uniswap purchases over time instead of buying all at once. This approach reduces the risk of entering at a poor price point during UNI's frequent 10 to 25% daily swings. The bot averages down your entry price during pullbacks, smoothing out the impact of volatility for long-term accumulation.

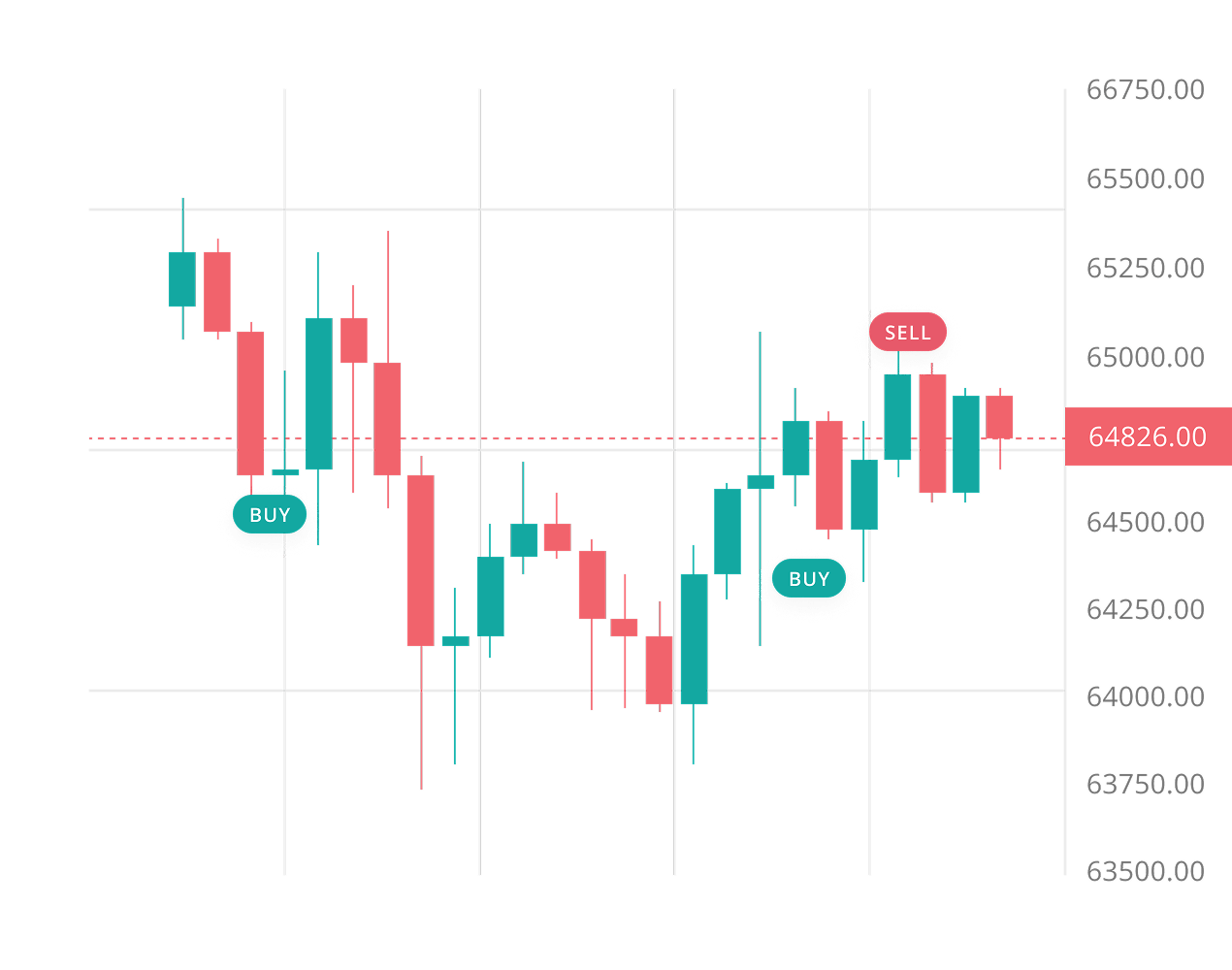

Learn moreGrid bots place multiple buy and sell orders across UNI's price range to capture profits from sideways movement. This strategy works well during consolidation phases when Uniswap trades within established support and resistance levels. The bot automatically buys low and sells high as UNI oscillates, taking advantage of the token's typical 5 to 15% swings within defined channels.

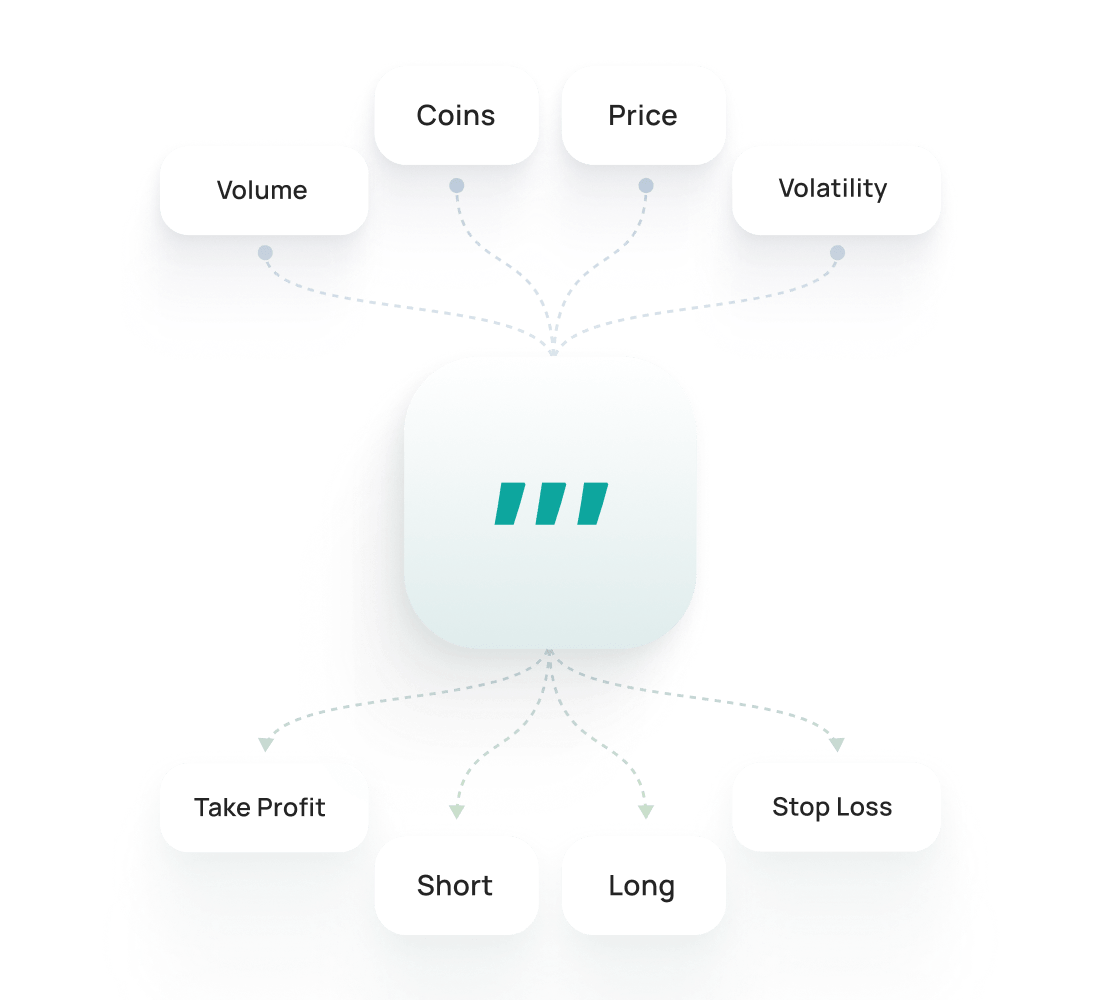

Learn moreSignal bots execute trades automatically when UNI reaches specific technical conditions based on indicators like RSI, MACD, or Bollinger Bands. This strategy removes emotional decision making from your trades and responds quickly to Uniswap's momentum-driven price movements. The bot reacts to technical signals faster than manual trading, capturing directional moves and trend reversals as they develop.

Learn moreThe Uniswap Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Uniswap SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Uniswap Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

Manual trading fails when emotions take over. Traders bought UNI at $11+ during V4 hype, then panic sold when it crashed 32% overnight to $8. You can't watch charts 24/7, and UNI moves fast. A 3Commas bot never sleeps or panics. It monitors Uniswap around the clock and executes your strategy automatically. Built-in Trailing Stop Loss and Take Profit protect you from sharp reversals without constant screen time.

UNI holders participate in governance decisions that shape protocol upgrades, fee structures, and the future development roadmap.

Uniswap processes the highest decentralized exchange volume globally, ensuring deep liquidity and minimal slippage for automated trades.

Multi-chain deployment across Ethereum, Arbitrum, Optimism, and Base provides flexible access to UNI with lower transaction costs.

Set wider stop losses around 8-12% to account for UNI's natural volatility, preventing premature exits during regular price fluctuations while still protecting against major crashes.

Monitor regulatory developments closely, especially the ongoing SEC case against Uniswap Labs, and watch for token unlock schedules that could trigger sudden selling pressure.

Never allocate more than 5-10% of your portfolio to UNI alone, and size positions based on your actual risk tolerance, not potential profits.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active Trading Accounts

5

Active DCA Bots

0

Active Signal Bots

2

Active Grid Bots

10

Active SmartTrades

20

Active DCA Trades

0

Active Signal Trades

10

DCA Backtests

1 year period

10

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active Trading Accounts

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

50

Active SmartTrades

100

Active DCA Trades

100

Active Signal Trades

50

DCA Backtests

2 years period

50

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$200/ month

AI Assistant

Spot & Futures

15

Active Trading Accounts

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active SmartTrades

5K

Active DCA Trades

5K

Active Signal Trades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Uniswap strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your UNI pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No, UNI bots don't guarantee profits. All crypto trading involves risk, and market conditions constantly change. Bots are designed to help automate your trading strategy and remove emotional decisions, but they execute the logic you set. While UNI's 5-15% daily volatility creates opportunities for automated strategies like grid trading, past performance never ensures future results. Bots are tools for disciplined execution, not profit machines.

Setting up a UNI bot on 3Commas takes about 5-10 minutes and requires no coding skills. You'll connect your exchange through API keys, select your bot type (grid, DCA, or signal-based), and configure basic parameters like investment amount and price ranges. 3Commas offers preset templates and SmartTrade options specifically optimized for tokens like Uniswap, so you can start with proven configurations and adjust as you learn.

Your funds remain completely safe on your exchange account. 3Commas never holds or controls your crypto—we're a non-custodial platform. The API keys you create only grant trading permissions, not withdrawal rights, so bots can execute buy and sell orders but cannot move funds off your exchange. You maintain full control and can revoke access anytime through your exchange settings.

Grid bots excel with UNI due to its volatility and frequent ranging patterns, automatically buying dips and selling peaks. DCA bots work well for long-term UNI accumulation if you're bullish on DeFi growth. Signal bots let you capitalize on directional moves triggered by governance updates or protocol developments. UNI's high liquidity across major exchanges ensures your automated trades execute smoothly with minimal slippage regardless of strategy.

Get trial with full access to all UNI trading tools.