Solana (SOL) Live Price

Market capitalization of a coin is calculated by multiplying the current price in USD or EUR of a single unit of coin by the current circulating supply of that coin available for sale or purchase on public exchanges.

Ex: If the price of BTC is currently $20,000 and there are 50,000 BTC available on public exchanges, then the Market Cap of BTC is $1,000,000,000.

Volume of a coin is the total spot trading volume reported by all exchanges over the past 24 hours multiplied by the value of an individual unit of that coin.

Circulating supply is the approximate number of units of a coin that are currently circulating in the market in the hands of the general public.

Release date is when the first tokens of this cryptocurrency were created and made available for mining or whatever other creation mechanism was specified in this token’s blockchain protocol.

Data provided by Coingecko API

SOL price Statistics

Solana Price Today

Price Change

The percent change in price for this asset compared to 24 hours ago

Trading Volume

Popularity is based on the relative market cap of assets.

Solana Supply

Circulating supply shows the number of coins or tokens that have been issued so far.

Solana Market Cap

Market cap is calculated by multiplying the asset's circulating supply with its current price.

Fully Diluted

Market Cap

Solana Price Yesterday

Solana Price History

The highest price paid for this asset since it was launched or listed.

Data provided by Coingecko API

SOL to JPY converter

Data provided by Coingecko API

Real-Time Solana Price Chart (SOL to JPY)

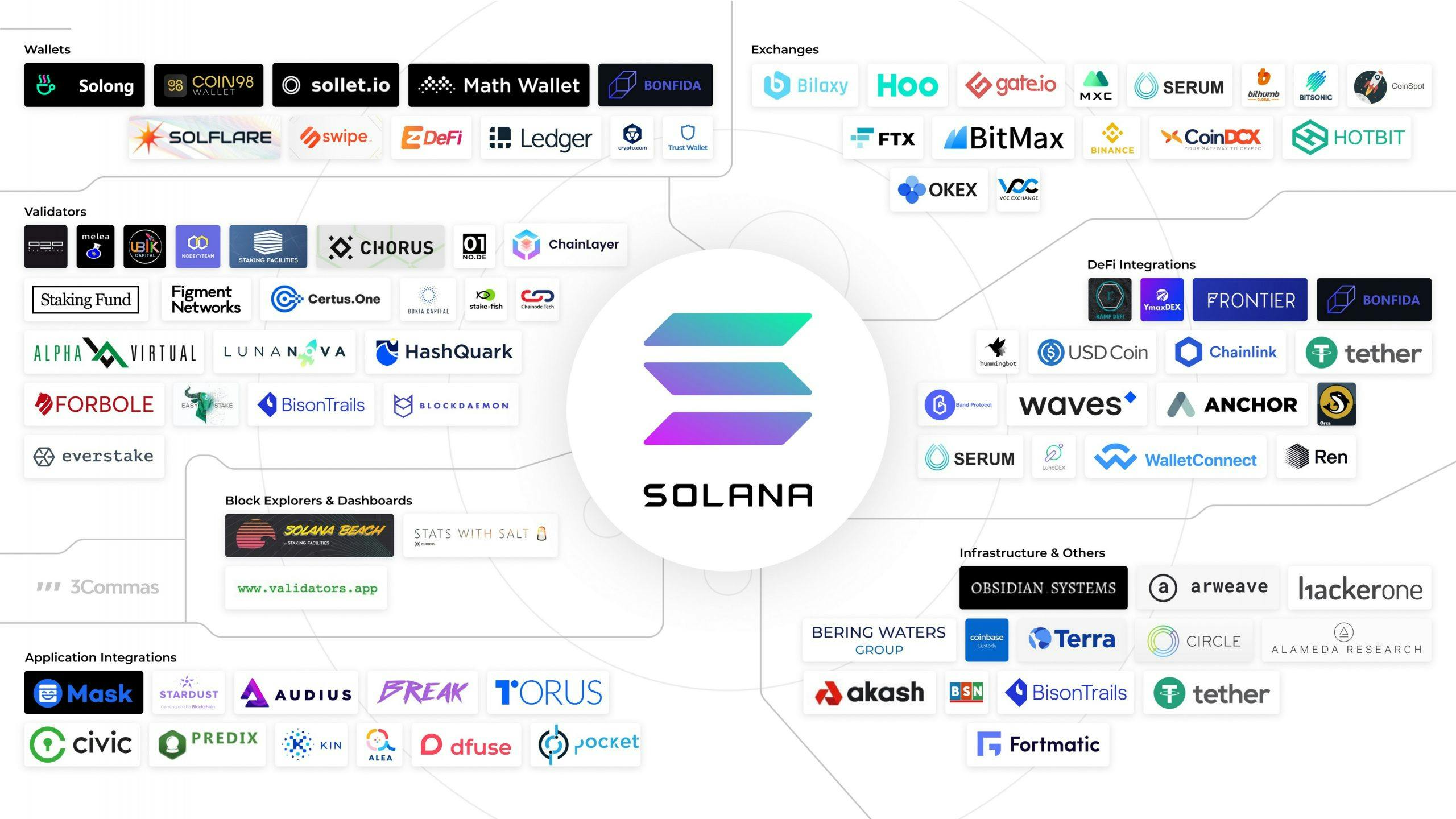

Solana Exchanges

Exchange | Price | Pair | Spread | 24 Volume | Last Traded |

|---|---|---|---|---|---|

Binance | JPY 20,282 | SOL/JPY | JPY 3 | JPY 248,998,960 | Recently |

Solana Historical Price Data (JPY)

Date | ||||

|---|---|---|---|---|

11/16/2025 | JPY 21,573.152643 | JPY 0 | JPY 22,002.066474 | JPY 20,909.583431 |

11/15/2025 | JPY 21,482.182235 | JPY 21,573.152643 | JPY 22,140.471764 | JPY 21,457.514646 |

11/14/2025 | JPY 22,360.828746 | JPY 21,482.182235 | JPY 22,387.2455 | JPY 21,291.497032 |

11/13/2025 | JPY 23,710.322135 | JPY 22,360.828746 | JPY 24,298.910528 | JPY 21,944.928813 |

11/12/2025 | JPY 23,829.991845 | JPY 23,710.322135 | JPY 24,896.03796 | JPY 23,640.583275 |

11/11/2025 | JPY 25,802.691216 | JPY 23,829.991845 | JPY 26,258.297561 | JPY 24,057.480453 |

11/10/2025 | JPY 25,265.682301 | JPY 25,802.691216 | JPY 26,148.410389 | JPY 25,265.682301 |

Data provided by Coingecko API

Crypto fear & Greed Index

Historical Values

Next Update

The next update will happen in:

0 hours, 10 minutes and 20 seconds

Explore Our Other Products for SOL

DCA Bot

Invest in SOL gradually and reduce risk using our supercharged Dollar-Cost Averaging Bot. Automate your entries at better prices, set take profit targets, and protect your capital with trailing stop loss. No coding required.

Signal Bot

Execute your SOL trading strategy using webhook signals from any source or using a TradingView Strategy.

GRID Bot

Capitalize on SOL price movements 24/7, even in sideways markets. The Grid Bot places smart buy and sell orders within preset ranges to capture every market swing.

FAQ

Actual price of Solana to Japanese yen now is JPY 20,268

Solana ticker is SOL

You can buy Solana on any exchange or via p2p transfer. And the best way to trade Solana is through a 3commas bot.

You should not expect to get rich with Solana or any other new technology. It is always important to be on your guard when something sounds too good to be true or goes against basic economic principles.

Solana (SOL) hit another all-time high over JPY 45,840 in 19.01.2025.

Solana Market Cap is at a current level of 11.23T, down from 11.75T yesterday. This is a change of -4.66% from yesterday.

Latest 24-hour trading of Solana (SOL) is JPY 1,166,341,700,000.

The current circulating supply of Solana is JPY 554,313,810 with the maximum amount of JPY 0.

Solana current Market rank is #7. Popularity is currently based on relative market cap.